Summary

- Healthcare marketers must identify the best channels, follow proven strategies, and deliver compelling messages to cut through the noise of 2023 and connect with enrollees.

- Effectively reach cost-conscious seniors by prioritizing all media channels — especially digital and direct mail — and focusing on value.

Now that the Medicare Advantage 2022 Annual Enrollment Period (AEP) is in the rearview mirror, healthcare marketers may be allowed a short breather before gearing up once again for a highly competitive advertising sprint to sign on the next group of recruits for 2023. With only seven weeks to persuade eligible consumers to sign onto their plan (October 15–December 7), providers must identify the best channels and strategies to cut through the noise and deliver a compelling message that resonates with both new 65-year-old consumers or current enrollees considering switching to a different plan.

Also of note is the growth trend: In 2022, two million more consumers enrolled in Medicare Advantage (MA), representing an estimated increase of 5.5% YOY, and bringing the tally to over 30 million Americans. This is, however, a lower increase than the last three years which may signal a slowing down of Medicare Advantage adoption and, consequentially, an even greater urgency for advertisers to reach new potential enrollees this year.

How marketers deliver their ads and how seniors consume them may prove to be very similar to last year’s recruitment period, given the current state of the economy and continued consumer concern over the high price of, well — everything.

Nearly one in four Americans reportedly delayed healthcare in 2022 due to costs according to Gallup’s annual Health and Healthcare poll. The 65+ audience is feeling the pinch of healthcare inflation as much as the average consumer: Four in 10 adults age 50+ are reportedly concerned with healthcare costs and are managing by cutting back on everyday expenses.

This mindset will place the importance of value at the forefront again, which means that top providers such as Aetna, UHC, and BCBS will have to find the best way to reach those consumers who are looking for a great price and more benefits (Think dental, eye, and hearing exams.). Communicating that value message and delivering it with a clear point of difference is critical.

Media Channels That Make a Difference

There are plenty of media options to choose from, when determining an AEP campaign strategy. But with limited time, a challenged share of voice, and (no doubt) limited budgets, it’s important to understand the role that each tactic plays in influencing the consumer, utilizing data.

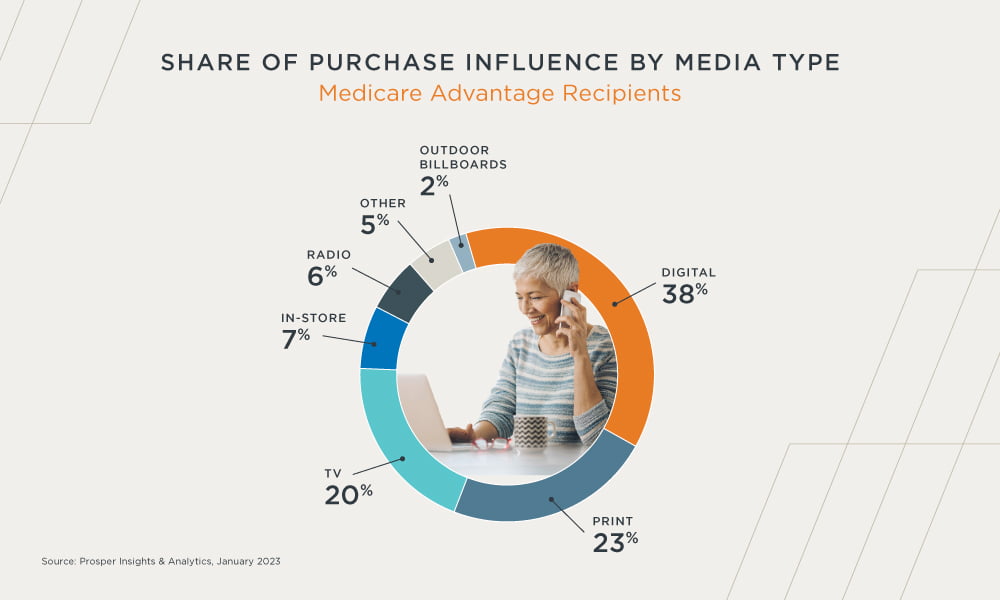

According to Prosper Insights & Analytics, Medicare Advantage recipients’ top choices for digital channels are internet and mobile ads while ad inserts and direct mail are the top media channels for print. Providers still rely heavily on getting their messages out via TV, yet print and digital media combined represent 61% of purchase influence for the Medicare Advantage consumer.

Direct Mail Is for Education, Information. Providers have embraced direct mail as a highly effective medium for delivering their content. Mintel reports 460 million direct mail pieces were focused on patient acquisition, between September and November 2022. The mailings stressed deadline urgency, offered QR codes for more information, and touted big benefits such as zero premiums.

This tactic works for the AEP audience, according to Vericast’s Awareness-to-Action Study from November 2022: 77% of respondents age 65+ said that they regularly look at ads that come in the mail. The same study also noted an added advantage: Seniors who are aware of the Save Direct Mail Package retain direct mail ads in their house an average of seven days.

Digital Is a Constant Reminder. Seniors have embraced digital, and they do their research. According to Media Logic, the top reasons seniors use the internet include email (#1) and to look up a business (#5). A digital ad provides a solid, sustained foundation for a campaign. In 2022, Vivvix Ad Insights reported that the top health insurance providers increased their digital spending during AEP by at least 15% (often much more), yet digital is still just 10–30% of the entire media mix, and TV is dominant.

Reevaluate the Type of TV

Traditional TV has been observed as repeatedly reaching the same audience, without incremental reach to new potential buyers, such as minority audiences, found Samba TV’s Q1 2022 State of Viewership Report. (Only half of eligible Black and Hispanic consumers were signed up for Medicare Advantage in 2020.)

Media Logic’s 2022 Senior Media Preferences Survey indicated that streaming is also now the most popular way for all seniors to watch TV. And yet, during AEP, healthcare marketers still dedicate 39% to TV and the top providers increased their TV spend 40% from September to November (according to Vivvix ad Insights). In an environment where budgets are scrutinized and cost per acquisition is mission critical, evaluating the components of a TV buy makes even more sense.

3 Essential Strategies

Just about 48% of all Medicare beneficiaries are now part of the Medicare Advantage program. As plan options grow and the economic outlook remains murky, the best a marketer can do is to double down on an effective, quality campaign for the next season of sign-ups.

1. Prioritize your media channels based on how seniors consume media across demographics. Use print products such as direct mail or ad inserts to inform and educate and allow digital products to serve as continuous reminders that prompt the consumer to click or scan for more information as they do their all-important research.

2. Target your highest potential consumers. Fifty-five percent of minorities are not yet signed up. Low-income and budget-constrained consumers are looking for discounts. Find your audience and then, within HIPAA guidelines, reach out with a message that resonates.

3. Leverage the importance of value to seniors and get the word out. Remember this consumer needs to manage increased costs, is looking for the greatest overall value, and is getting bombarded with a ton of information and promises. According to Vericast’s Awareness-to-Action Study, 27% of consumers would switch to a different health insurance plan if a competitor had an appealing offer. Stand out by prioritizing what’s most important and follow up with secondary information.

Download our healthcare playbook to learn more about the importance of implementing omnichannel healthcare campaigns to effectively reach today’s healthcare consumer.