Every month, up to five percent of the population shops for new loans.

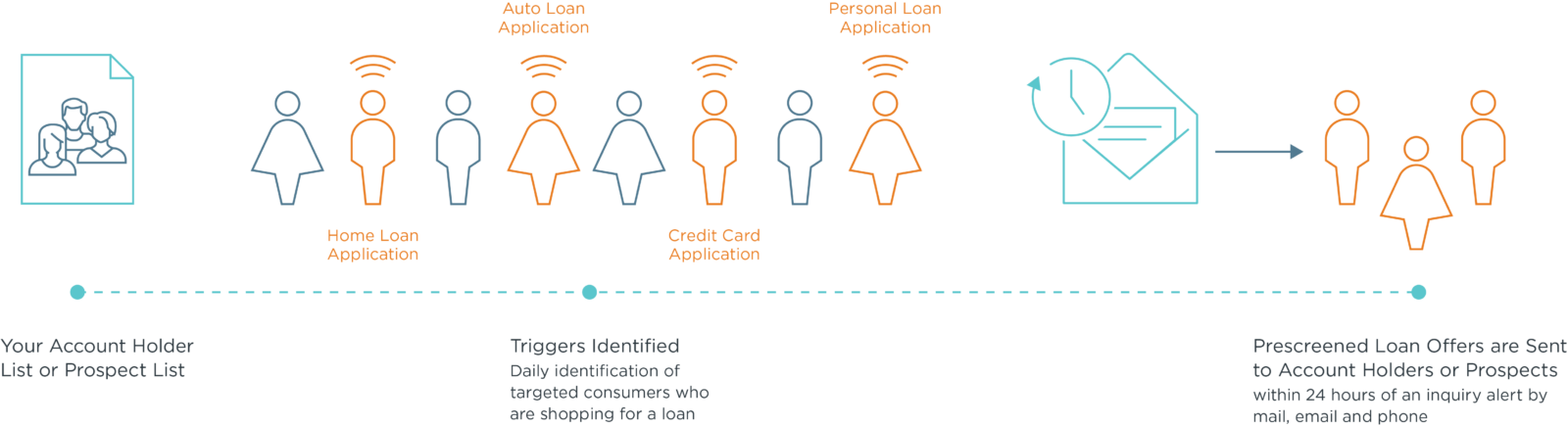

Wouldn’t it be nice to know when and what consumers are shopping for, so you can get their business instead of a competitor getting it? With Vericast’s Trigger-Based Loan Acquisition and Retention solution, you can offer prescreened, FCRA-compliant consumer loans to shoppers within 24 hours of a credit inquiry via direct mail, email or phone. We help take the guesswork out of marketing mortgage, home equity, auto, credit card, and other loans by focusing on qualified buyers based on your underwriting criteria, increasing their likelihood to respond — and allowing you to make the most of your marketing dollars.

How It Works

RESPOND TO TODAY’S ALWAYS-ON CONSUMER

With Trigger-Based Loan Acquisition/Retention you can:

- Increase retention by engaging consumers who are actively shopping for loans

- Maximize marketing spend by identifying borrowers likely to respond to loan offers

- Improve the customer experience by offering loans when they need them

- Engage consumers through integrated, multichannel communications

Case Study

Trigger-based Acquisition Solution Paves Way for Flood of Loan Applications for a Credit Union

When a credit union with $1.2 billion in assets needed an effective and proven alternative to its loan acquisition efforts, the credit union called on Vericast.

You may also be interested in…

Expanding loan portfolios is a priority for financial institutions, yet competition and regulatory complexities make growth more challenging. With economic growth slowing and interest rates expected to decline, banks that balance opportunities with headwinds will thrive.