In our yearly survey of financial services marketers, we asked respondents from banks (57 percent) and credit unions (43 percent) about their budgets for 2017. Are they growing or shrinking? An impressive 92 percent of marketers expect an increase or no change in their marketing budgets this year, which suggests that financial institutions are increasingly finding the value in marketing.

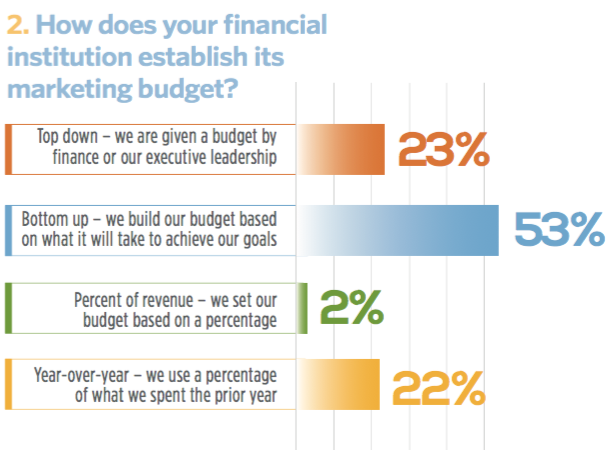

Another indicator of the growing confidence in marketing’s ability to make a financial impact is the BYOB trend. Marketers reported greater autonomy than ever in determining their own planning and spending, hence Build Your Own Budget.

For the first time in our survey, we’re seeing budgets built from the bottom up surpass the 50-percent mark. Meanwhile, top-down budget creation continues to shrink (23 percent); and budgets as a percentage of revenue are now negligible.

These figures underscore a theme: Marketing’s value and ability to deliver results.

It’s clear that financial institutions of all sizes consider their marketing teams to be partners in driving strategy and business decisions. The upside of this is greater autonomy in setting the budgets that are needed in order to achieve business objectives. It comes with the expectation that marketing programs produce a positive ROMI. Your ability to demonstrate marketing’s contribution will impact next year’s budget and how much BYOB you can expect.

Marketers, it’s up to you to prudently manage your budgeting freedom, making sure your campaigns and expenditures earn your senior leadership’s confidence.

Caution: High Expectations Ahead

Last year’s survey revealed an increasing reliance on measurable campaigns and analytics, driven by the increased use of digital channels. This year’s survey reveals more autonomy for marketing departments to determine their own planning and spending.

> Download the full report now