It’s a new year and already people are looking to act on money-focused resolutions. Pew Research previously uncovered that of Americans who make new year’s resolutions, 61% say those resolutions are focused on money and finances. Financial institutions (FIs) have a prime opportunity to show up for consumers as they activate their financial plans for 2026. To identify how consumers are making financial decisions in a changing economic environment, Vericast surveyed 1,000 U.S. adults in December 2025 for our 2026 U.S. Consumer Financial Planning Study. The responses uncover what priorities consumers have, guidance they need from their FIs to help build confidence and decrease stress, and sentiment around alterative payment services

Consumers Are Looking to Prioritize Financial Control in 2026

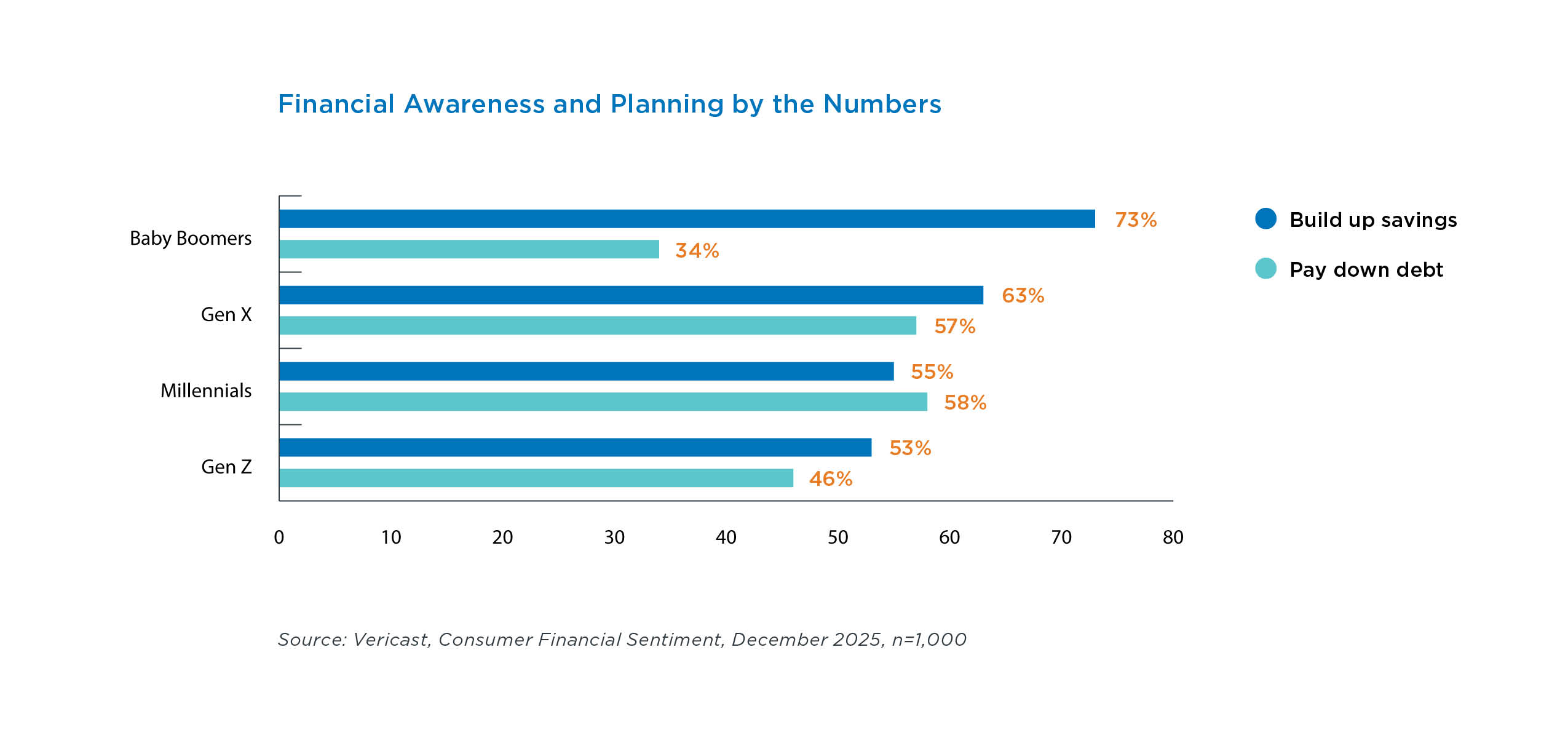

People have two critical focal points for this year: Building up savings and paying down debt.

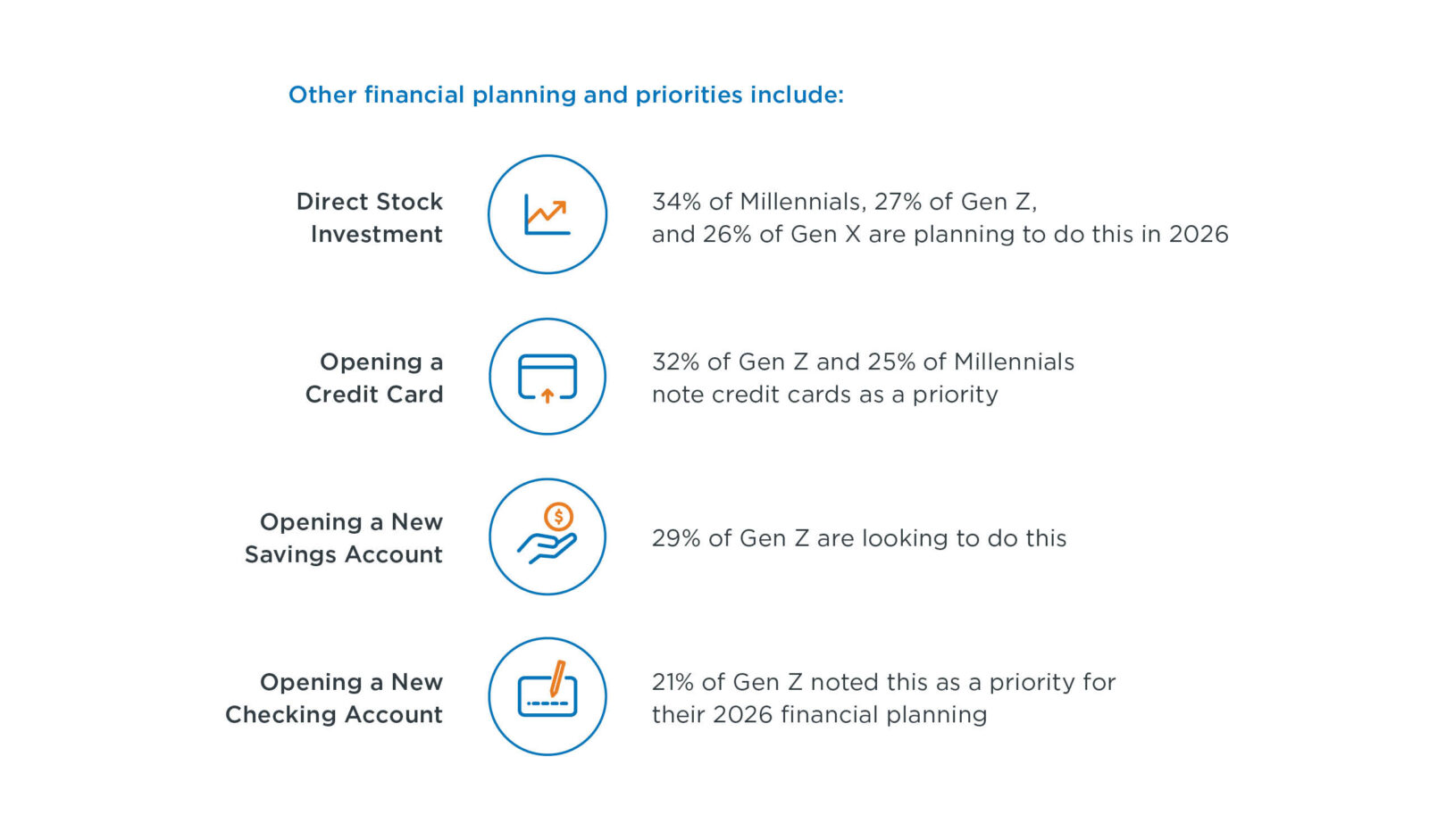

Other financial planning and priorities include:

2026 also shows a shift toward intentional spending. Nearly half of survey respondents say they’ve cut back on influencer-inspired purchases. Largely a result of the de-influencing trend on social media, consumers seem to be focusing more on sensible investments instead of overhyped “it” products. People are thinking more critically about what they need and spending money there versus spending based on in-the-moment wants.

Banks and Credit Unions Have Opportunity for Growth and Risk for Churn

Consumers are aiming to make practical financial moves this year with older generations focused more on savings (likely with retirement in mind) and younger generations prioritizing debt payment, investment options, and opening new accounts.

FIs that can identify intent signals early and deliver timely, relevant offers will be able to more adeptly capture new accounts and prevent attrition. As consumers reassess their financial planning for the year, precision targeting and lifecycle-based marketing will be critical to meet them where they are and maximize on those moments of reevaluation.

Local FIs Remain a Trusted Anchor, but Financial Guidance is Fragmented

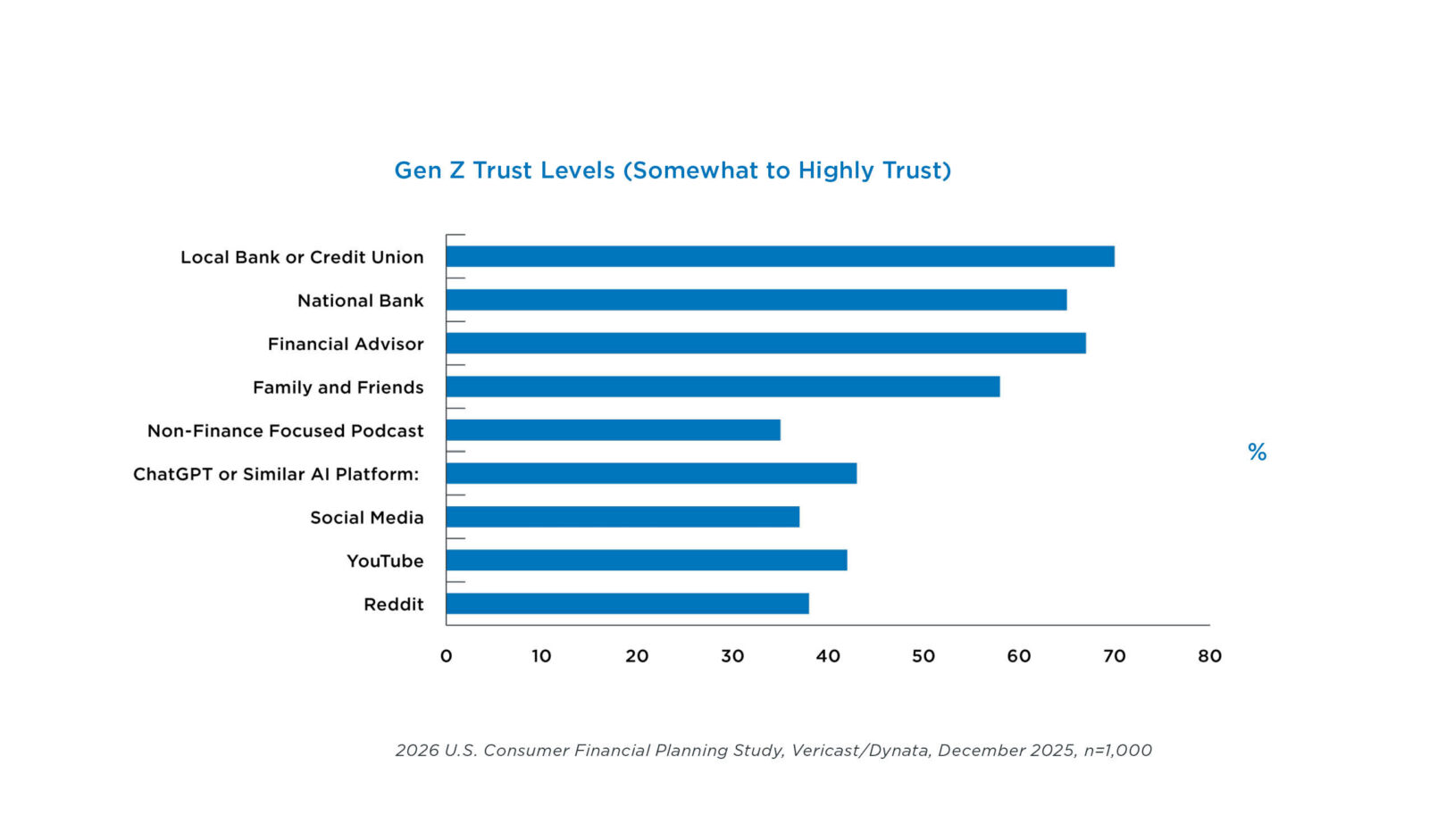

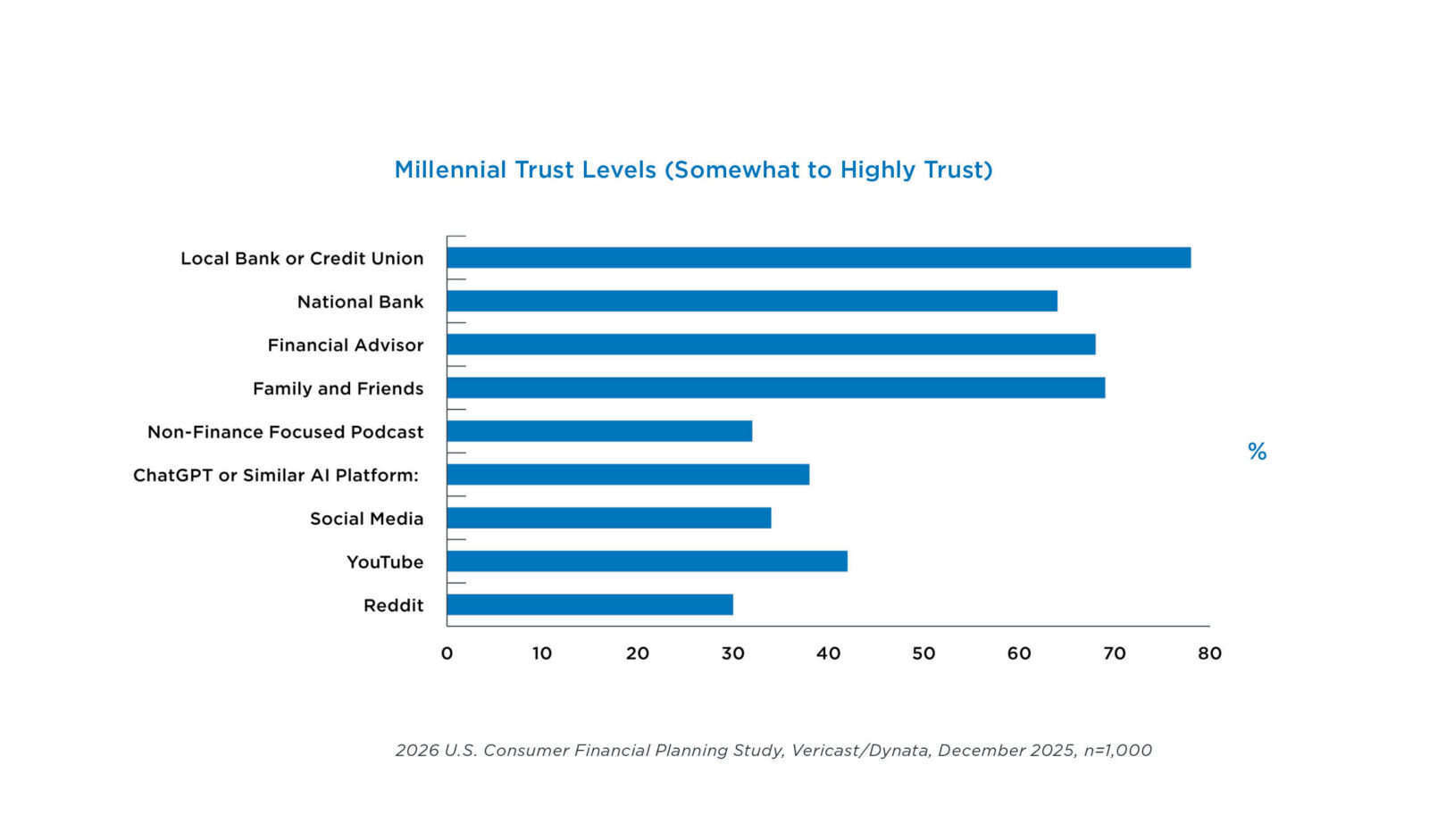

Headlines from the past couple years may show that social media sites are rising as a source for consumers to get financial advice, but this doesn’t paint the full picture. While 2025 data from Gallup found 42% of Gen Z aged adults look to social media for financial information, the survey also uncovered that most respondents across age groups rely more on other sources like friends and family, financial advisors, and FIs.

Our data shows similar conclusions:

- 74% of respondents trust financial advice from local banks and credit unions

- 63% say they trust the advice of national banks

- 69% place trust in financial advice from a financial advisor

- 63% of respondents note that they trust getting financial advice from friends and family

Interestingly, there is a hierarchy of what sources consumers actually end up taking advice from.

- 55% have taken the financial advice of a friend or family member

- 43% say they have taken the advice of a financial advisor

- 37% take the advice of local banks and credit unions

- 21% take advice from national banks

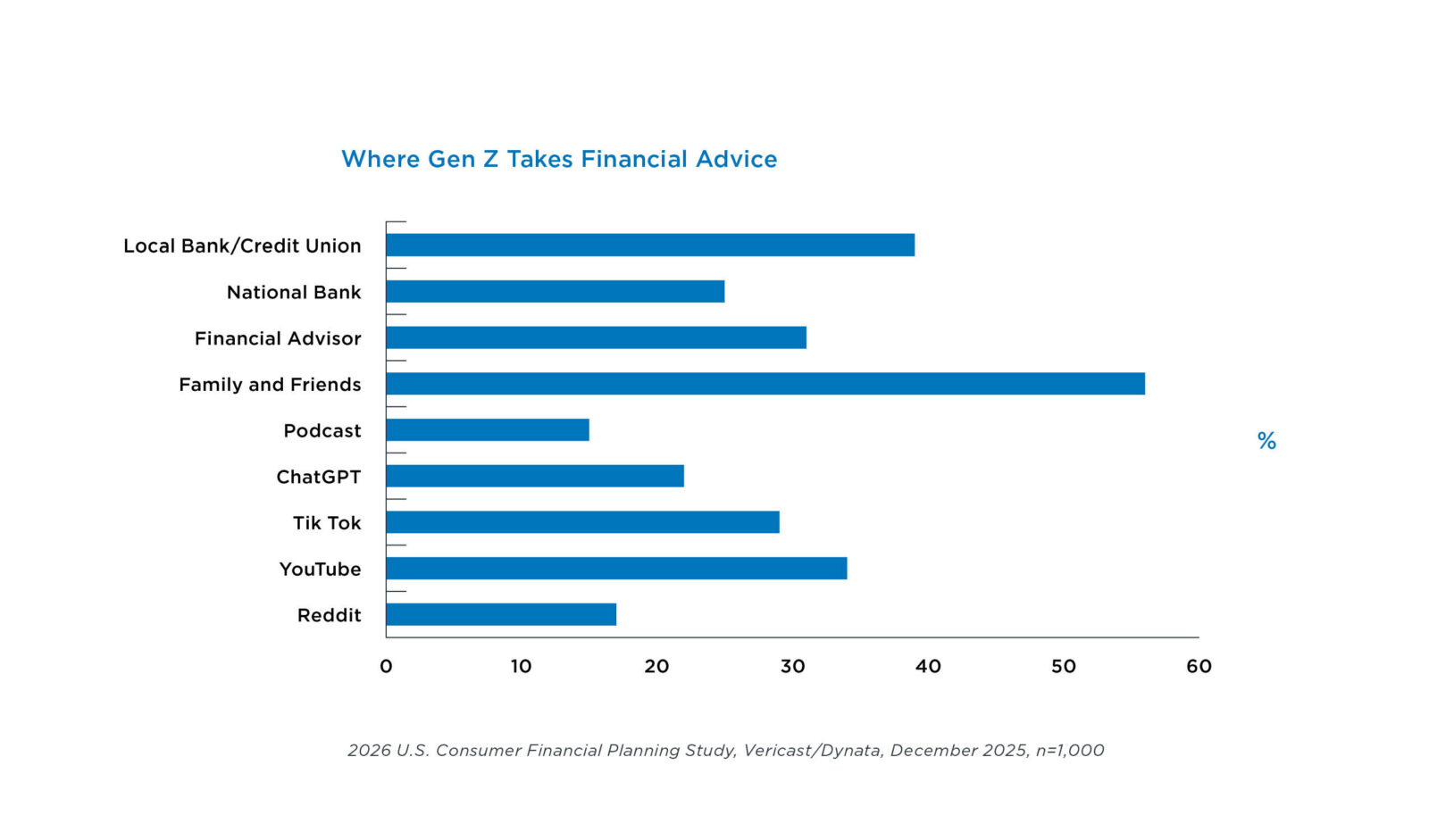

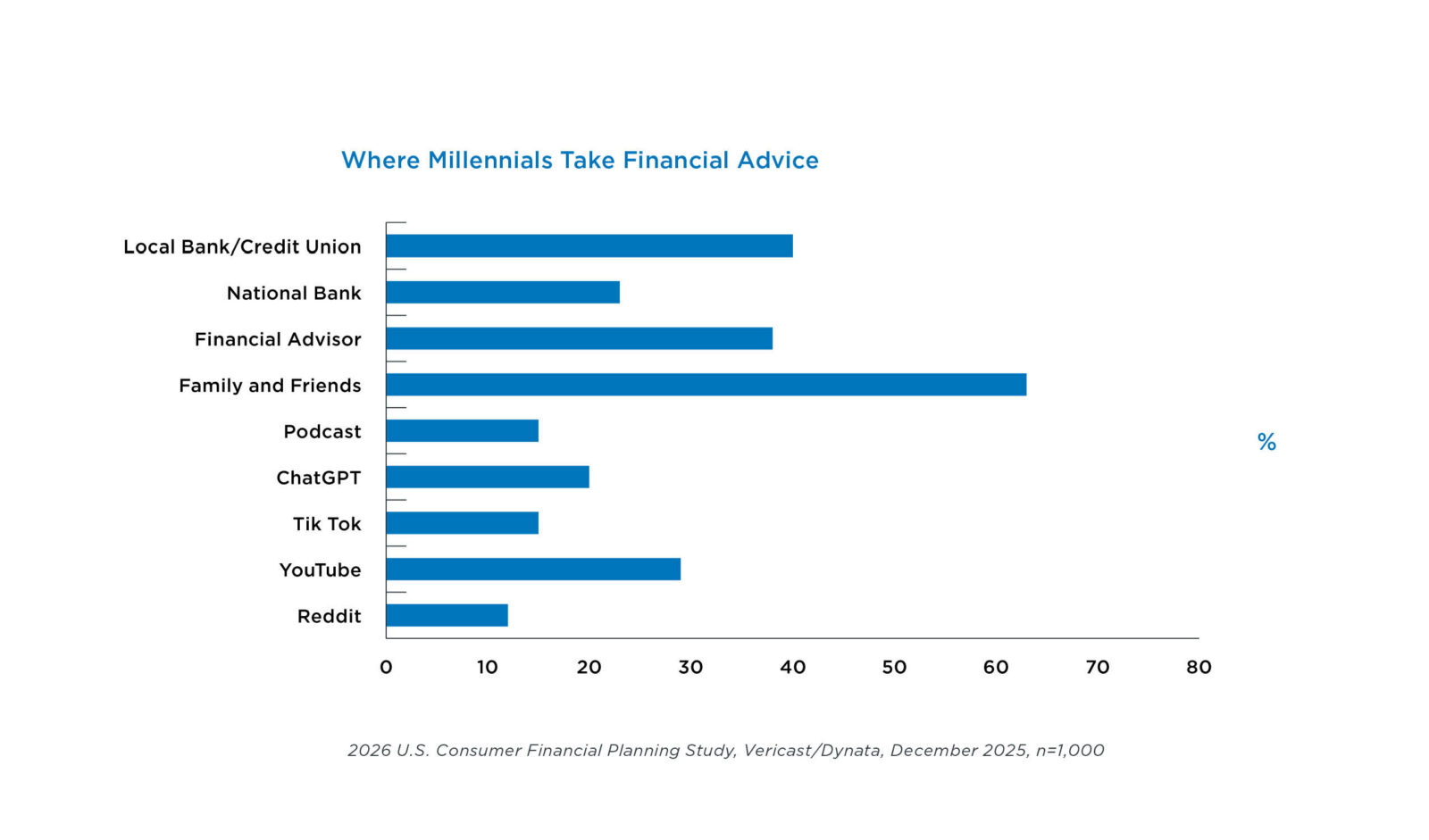

Younger Consumers Are Experimenting with Where They Get Financial Advice

Millennials and Gen Z do increasingly show a growing trust in financial advice from social media and community platforms. But they also still rely heavily on more traditional sources like FIs, financial planners, or friends and family.

FIs need to consider how consumers are looking to diversify where they get financial information and advice from. At the same time, it’s important to consider what sources consumers actually take that advice from.

FIs Must Remain Visible and Relevant Across Channels

Target audiences are showing up across more varied surfaces than ever. For example, short-form video platforms resonate highly with younger generations, so it’s important that FIs engage there in meaningful and authentic ways to capture consumer attention. As financial guidance becomes increasingly fragmented, FIs that pair inherent credibility and trust with modern, personalized, and discoverable marketing across channels can remain relevant.

To Restore Consumer Confidence FIs Must Show Visual Progress

Confidence in financial institutions is growing, but it isn’t necessarily strong. Just a third of respondents noted being very confident that their FI can help them make progress toward their 2026 priorities. Nearly half (49%) instead say they are only somewhat confident in their FIs ability to help them.

Outright distrust remains low, but a dominance of “somewhat confident” among survey respondents suggest banks and credit unions need to do more to actively demonstrate value, progress, and relevance. Just 18% said the trust they have in their FI doesn’t need improvement.

Here’s what consumers say they need to increase trust in their FI’s financial guidance this year:

- Lower Fees and Better Interest Rates (46%)

- More Personalized Recommendations (32%)

- Tools to Track Financial Progress (30%)

- Proactive Alerts and Nudges (22%)

- Educational Content (20%)

Lower costs paired with personalized, progress-oriented tools is the name of the game in 2026. Additionally, younger generations are looking to their FIs to proactively guide them with relevant recommendations – 39% of Millennials and 40% of Gen Z. FIs have an opportunity to be more aggressive about rate change communications or new tools that match generational preferences.

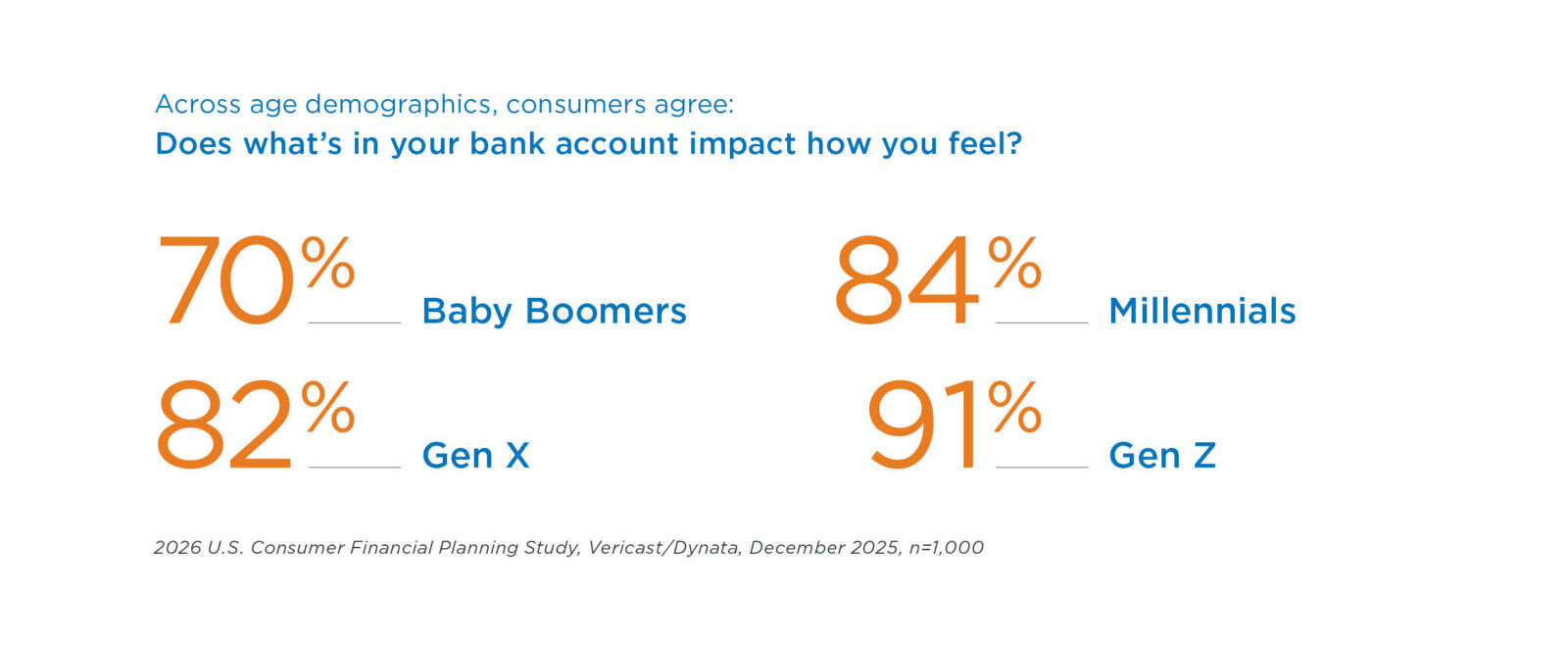

Widespread Financial Stress Requires Focus on Empathy and Relevance in Marketing

It’s clear that a contributing factor to the fall in consumer confidence is stress about finances. When asked if the amount of money in their bank account impacts their mental health, 82% of respondents agreed.

Marketing and communications should be centered on demonstrating tangible progress, outcomes, and relevance tied to individual financial goals. FIs that support this with data-backed insights and performance-driven messaging will build more confidence and trust across demographics.

BNPL Gains Traction but FIs Struggle to Capture the Demand

Millennials and Gen Z were no strangers to leveraging buy now, pay later (BNPL) options to make purchases in 2025.

| BNPL Service | Millennial Use in 2025 | Gen Z Use in 2025 |

| PayPal Pay In 4/Pay Later | 31% | 34% |

| Affirm | 23% | 20% |

| Afterpay | 26% | 28% |

| Klarna | 21% | 27% |

What was missing? The use of BNPL-style services direct from FIs. Only 7% of both Millennials and Gen Z used this type of service in 2025. At the same time, 26% of respondents expect to finance more purchases in 2026 than they did in 2025, and that number gets even higher for Millennials (31%) and Gen Z (43%).

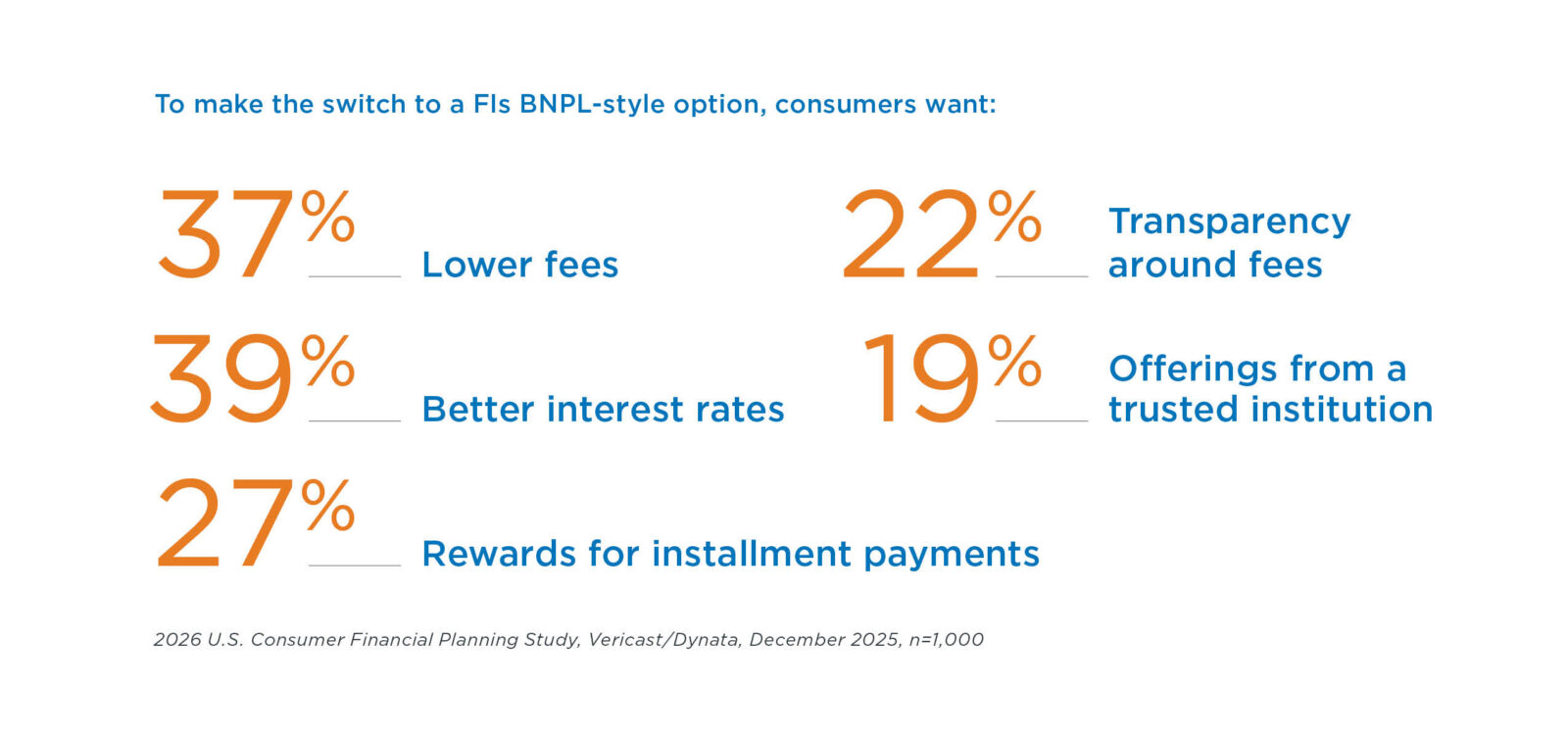

BNPL From FIs Lacks Targeted, Value-Driven Activation and Awareness

Consumers are open to switching to a bank-led BNPL service so long as the value proposition is clear.

So, what are FIs missing when it comes to getting consumers to use their BNPL offerings? Differentiated messaging explaining why bank-led options are better.

Precision targeting in how FIs market their BNPL-style services will be essential for drawing in younger consumers, as they have much more interest in this payment offering than older age groups. Any FI that wants to grow BNPL adoption in 2026 should look to how the benefits are communicated in marketing collateral to ensure it is geared towards the right audiences and consider gamifying offerings with things like earned rewards.

How FIs Show Up for and Communicate with Consumers is What Matters in 2026

Meeting consumers where they are and providing them with what they expect and need will hinge on how well FIs can tap into what people are looking for. Marketing messages will need to be more tailored and personalized than ever to fit preferences not only demographically but down to the individual level. Empathy and timeliness must go hand-in-hand to both acknowledge financial stressors while building up confidence and trust in services and offerings that give consumers practical and achievable paths forward.