People are saving significantly less than they were just a few years ago and financial institutions need to adjust their thinking and approach to getting deposits. Planning for the new normal is key. The path to deposit growth may lie with winning large volumes of small savers.

What’s Going on With Deposits?

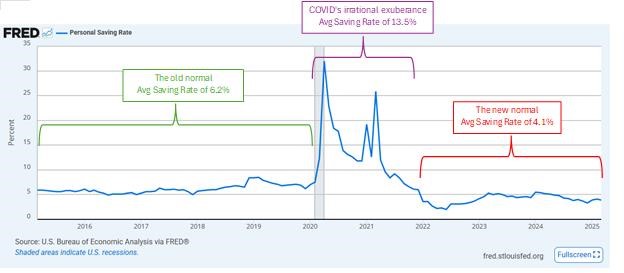

They say a picture is worth a thousand words. This one is worth nearly $14T dollars.

The blue line shows the personal savings rate for the U.S. This means the percent of disposable income (after taxes) that the normal person is able to save and invest. For a long time, that rate sat north of 6%, or a savings $6.20 for every $100 after taxes. After the pandemic, stimulus payments were issued, people stayed home, and the ability to save went through the roof. This resulted in the savings rate more than doubling.

Then, inflation hit. Wages stagnated. People spent money. And we are now at a new normal savings rate of 4.1%, an obvious drop-off from both the old. At a macro level in the U.S., this drop in the savings rate means $14 trillion in savings that financial institutions would have expected under the old normal model has not come to fruition under the new normal.

What It Means For the Average American Household

According to the Federal Reserve Bank of St. Louis, in the US, the average household has annual disposable income of $51,147. Prior to COVID, that house would have been able to put nearly $3,200 dollars into some type of savings account. Today, that same house is saving only $2,100 per year. That household has lost a lot of their perceived safety net for unexpected expenses; and the financial institution has a less active and engaged customer.

The Deal With Debt

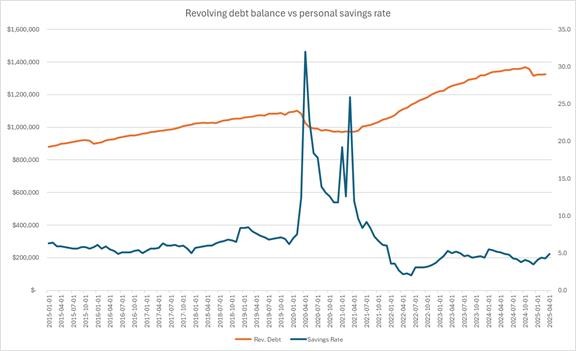

While deposit rates are dropping, revolving debt balances continue to grow which is leading to an ever-widening imbalance between these key measures for the banking sector. As this divide increases, financial institutions will face increased pressure to keep their portfolios in sync. The path to deposit growth may sit with winning large volumes of small savers.

Source: Revolving Consumer Credit Owned and Securitized (REVOLSL) | FRED | St. Louis Fed

On the Search For Savings

With the economy showing mixed signals, many financial institutions are in “wait and see” mode, leaving the deposit market ripe for disruption. Consumers are increasingly sensitive to interest rates and yields. Competition is intense, and competitive rates, especially for CDs and money markets, remain crucial for acquisition.

Consumers are actively seeking out the accounts that will serve them the best. Savings account search terms are projected to be flat over 2025.

The top savings account related search terms are:

- Online Savings Account

- Savings Account Interest Rates

- Kids Savings Account

Conversely, when it comes to higher yielding accounts growth is anticipated. CD search trends are projected to increase over 2025 and into 2026.

The top high-yield/CD account search terms are:

- CD vs. High Yield Savings

- Share Certificate Calculator

- Best 2 Year CD Rates

Financial institutions can enhance their advertising strategies by focusing on local search patterns rather than relying on generic nationwide messages. Community financial institutions can utilize their physical presence to create ads that emphasize community involvement, showcase real staff members, and reflect the unique personality of the neighborhood.

4 Ways You Could Prepare

In addition to this strategy, it’s crucial to adhere to best practices for search optimization. Financial institutions should:

- Conduct thorough keyword research to identify terms relevant to their local audience.

- Optimize their website content for these keywords to improve organic search ranking.

- Utilize geo-targeting in paid search campaigns to reach local consumers effectively.

- Create high-quality, localized content to engage the community and highlight their services.

Vericast can help you grow your deposits. Contact us to have a conversation about your deposit strategy and localized search solutions.