Buy Now, Pay Later is growing. Financial institutions shouldn’t sit idly by.

The model of a Buy Now, Pay Later (BNPL) purchase has been around for a long time, but it’s rapidly growing in usage and becoming a larger problem for financial institutions, one they can no longer ignore.

BNPL: Previously Optional, Now Essential

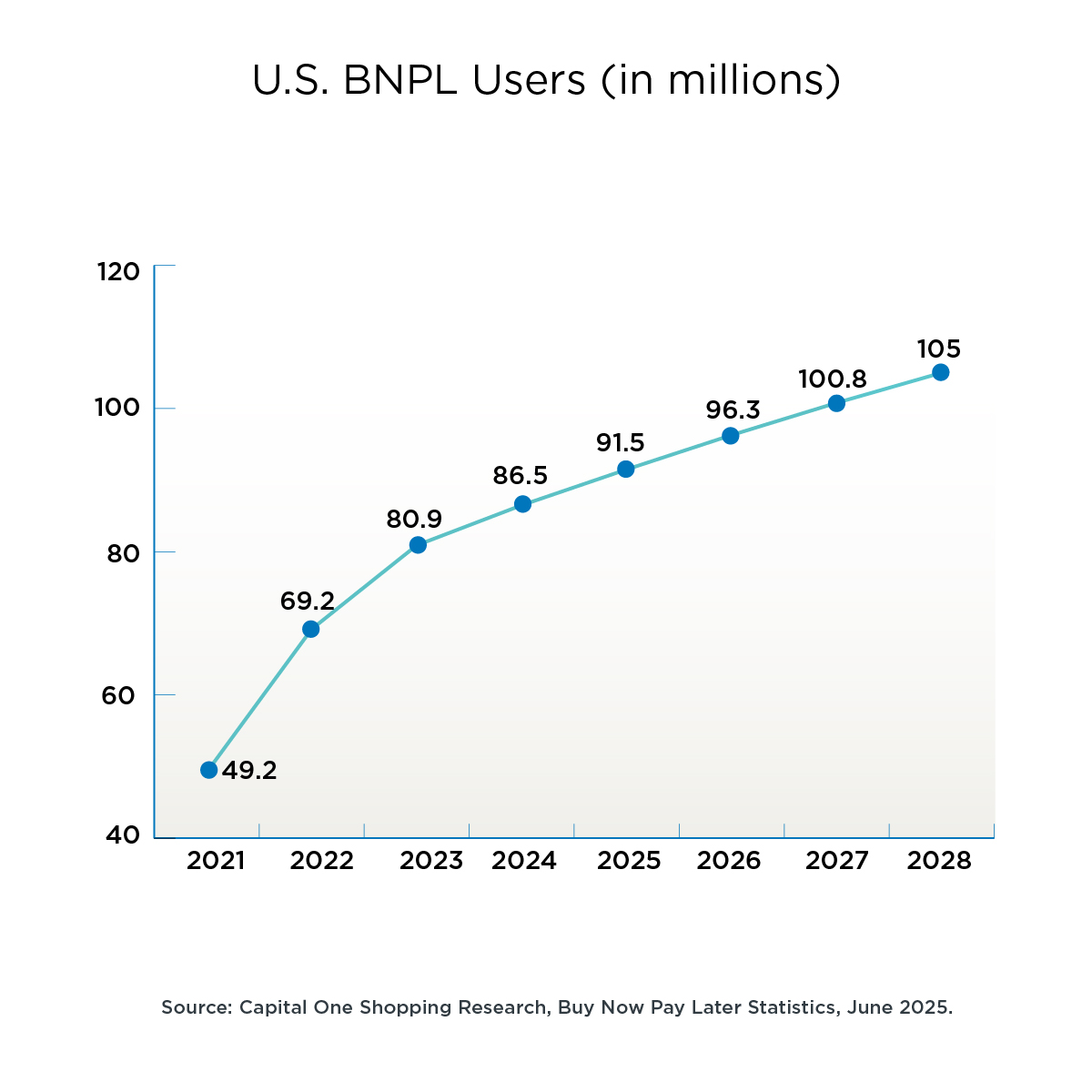

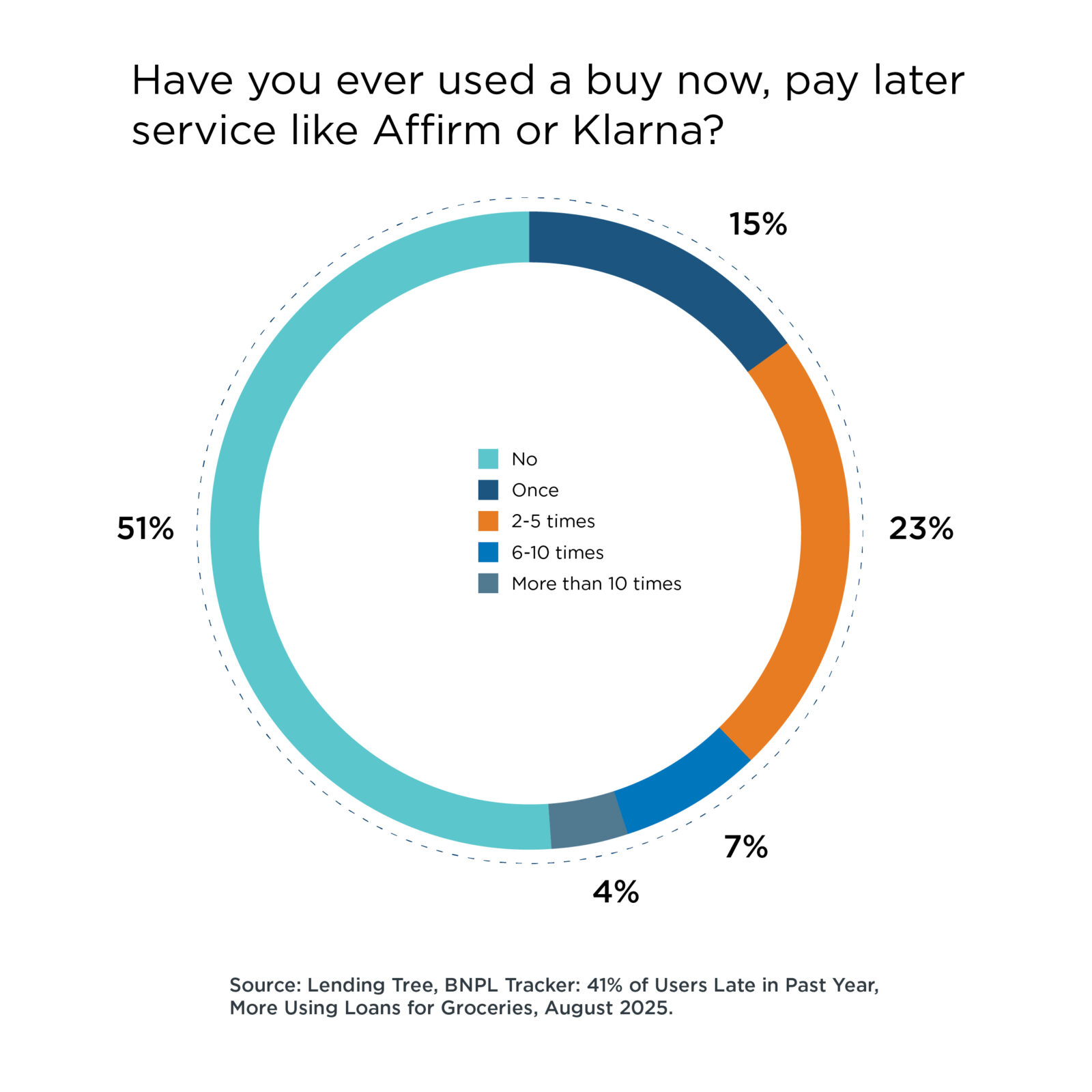

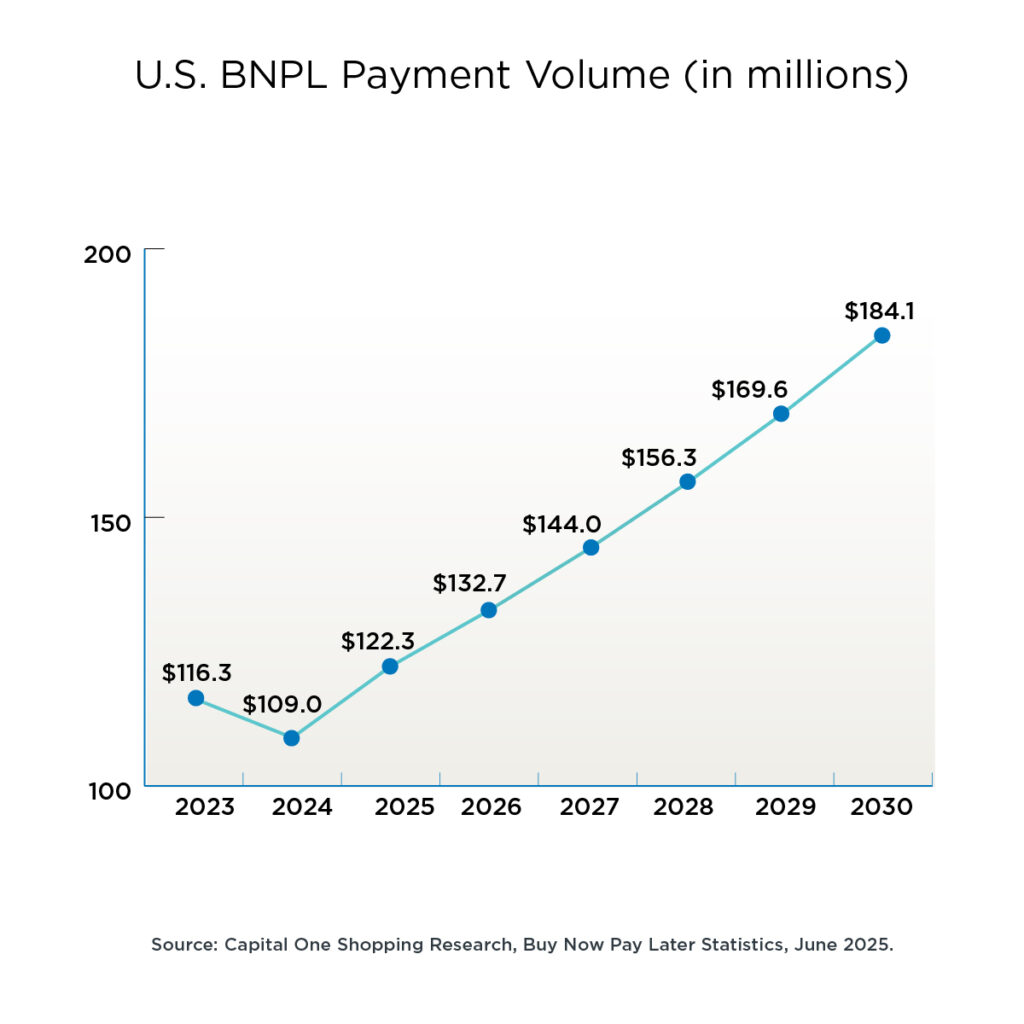

BNPL has become a more crucial tool in the consumer portfolio. Recent data and models indicate extensive usage.

That level of usage comes with a growing price – a price that is pulling dollars away from traditional banking-driven methods to outside sources.

Consumers are increasingly choosing BNPL which largely takes the bank or credit union out of the equation. They either aren’t offering attractive small and short-term options or are failing to get their message across before the purchase happens. Credit card and personal loan offerings are likely to see increased struggles with market share and adoption if the projections shown above come to fruition.

You might also think BNPL is used for larger purchases (new refrigerator, house renovation) but it’s becoming more common for normal purchases. Klarna offers BNPL at Domino’s Pizza, Publix supermarkets, and Foot Locker. These examples show that companies are recognizing the value and need to provide customers with a payment option that delays or spreads out the payment. And all of this is happening without FIs playing a role.

BNPL is attractive to younger generations, but it is also causing problems.

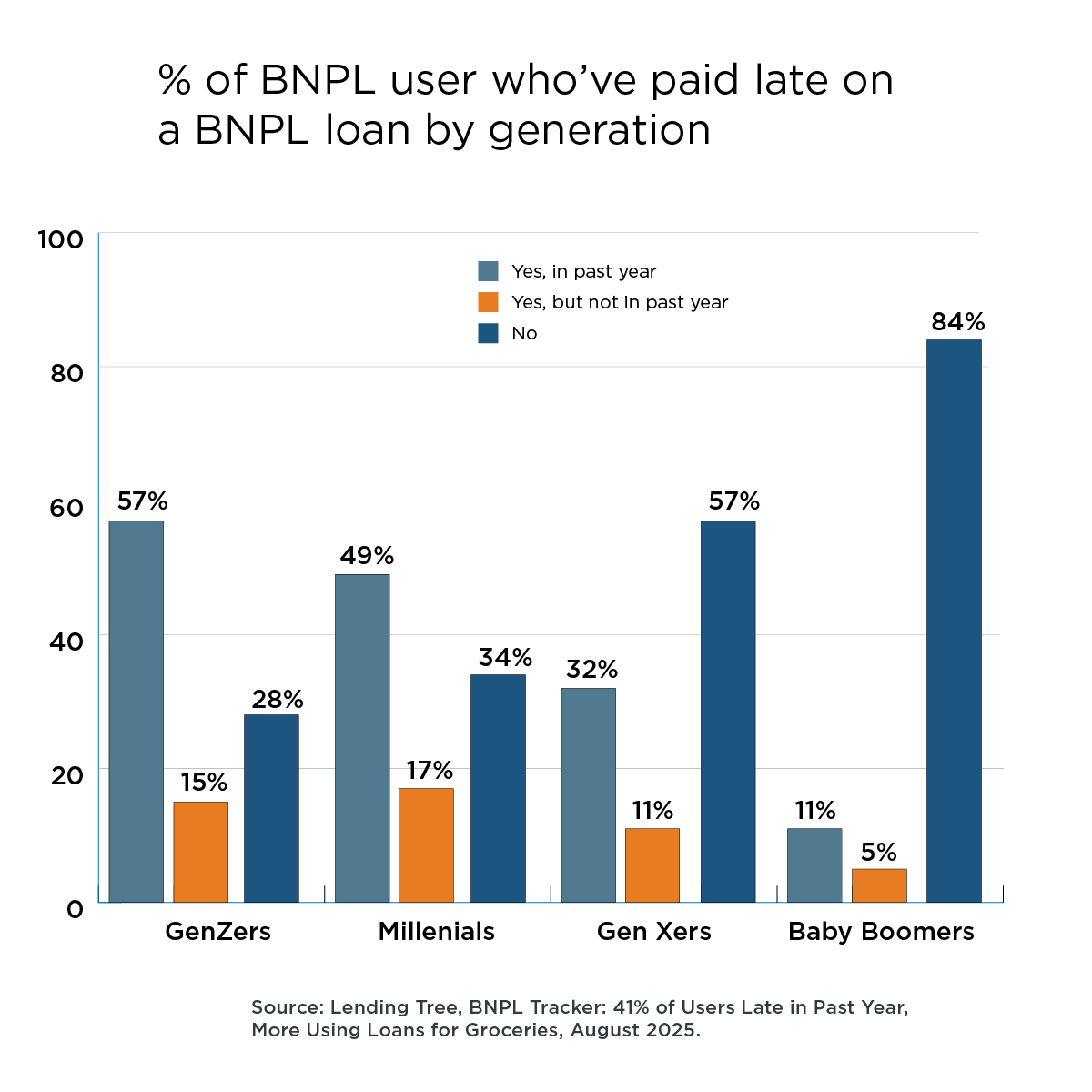

42% of Millennials and Gen Z are using BNPL, double the amount for all other generations. Gen Z uses BNPL more than credit cards. While these groups may not have the most attractive portfolios for FIs to go after, they do represent the next generation of customers. BNPL has shown greater appeal than what traditional institutions have been offering.

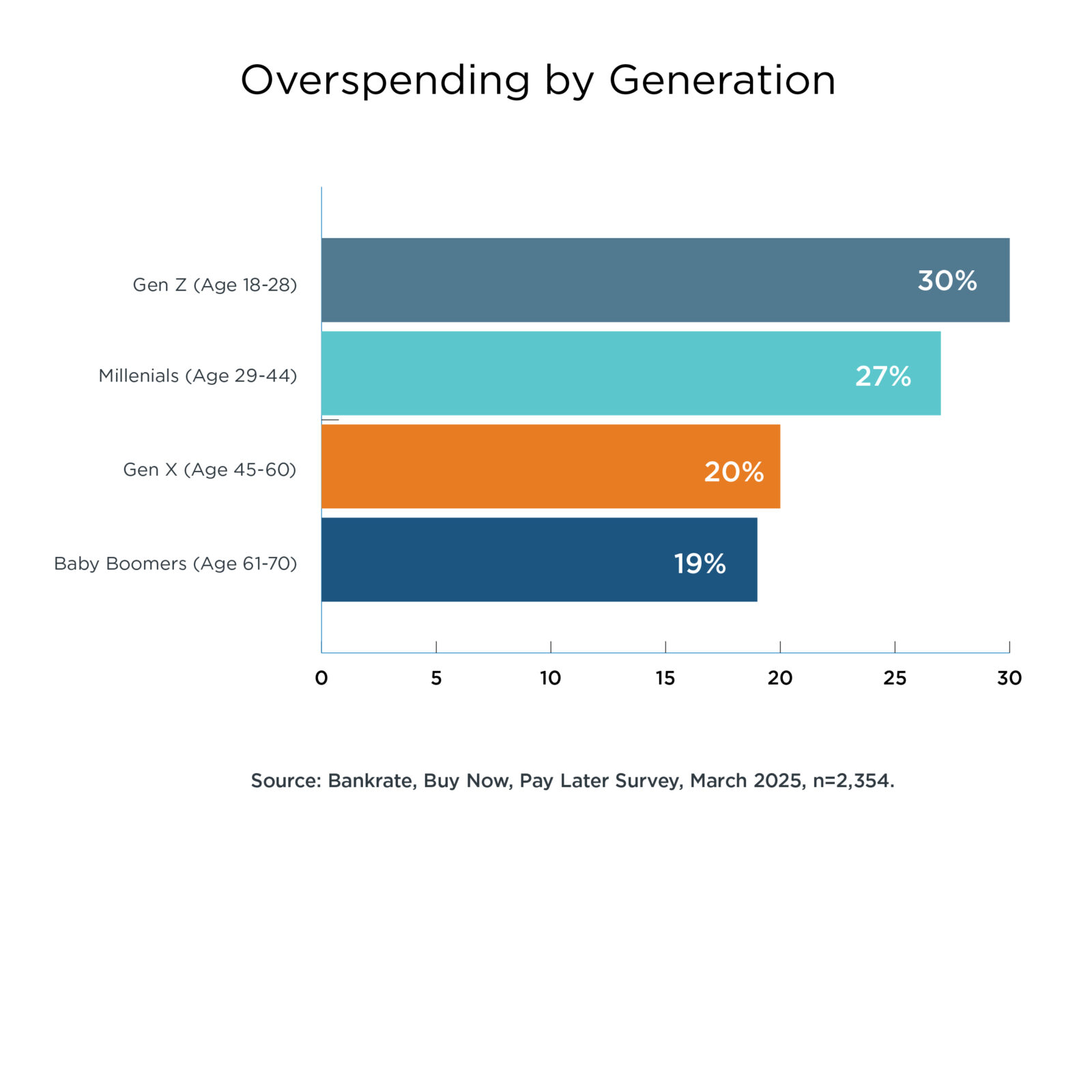

However, the heaviest generational users from above also have the most difficulty with on-time payment. 41% of users were late with payments, and those delinquent payments come with massive fees of up to 30% interest.

Most of those younger heavy users are missing payments and digging an even bigger hole. Debt stacking and a false sense of financial ability are becoming larger problems for generations that need guidance and education on safer alternatives to managing their household budgets.

BNPL can represent much more risk to the consumer than traditional lending options.

- 31% of users have lost track of payments.

- 39% of users regret having chosen that option once they see the costs.

- 49% of users have experienced negative issues with the service.

- BNPL fees are higher than traditional methods.

All of these are strong points to market against as long as banks and credit unions effectively share their message.

What you need to know

BNPL activity should make it clear that there are massive lending opportunities in the marketplace. Banks and credit unions are at major risk of losing market share in their lending products unless they act quickly, effectively, and in a timely manner.

The industry is beginning to react

FIs are stepping in to take a leading role in clawing back customer usage. Currently some banks are wading into BNPL space by pre-approving their consumers for a BNPL installment loan waiting in the wings for use. With the CFPB classifying BNPL accounts as credit cards in May 2024, FICO adding BNPL repayment data into FICO SCORE 10 BNPL and FICO SCORE 10T BNPL, there will eventually be a credit risk bill to pay for consumers with poor repayment behavior (except for those living in New York State). Repayment behaviors and use of BNPL are bound to change.

Final Thoughts

BNPL usage is a massive rabbit hole of information but what is a growing industry of strength is built on a rickety underlying structure. Banks and credit unions can get on the marketing offensive to recapture loan dollars that have shifted away by providing safer and flexible alternatives that help households buy what they want without falling into longer-term problems. Banks and credit unions that plan strategy and message now will be in the best future position to benefit.