It’s all about perception.

Right now, banks may not have the best image in the public’s eye. The fall of SVB and other financial institutions could create a big question mark in the minds of customers.

Is my bank safe?

How do I know if my money is safe?

Am I getting the most value for my money?

Overcoming Preconceptions

The banking blip has given certain customers cause for concern and some are evaluating where they stash their cash. While deposit flows have stabilized following the historic run on deposits at SVB and Signature, some consumers continue to reassess their banking habits.

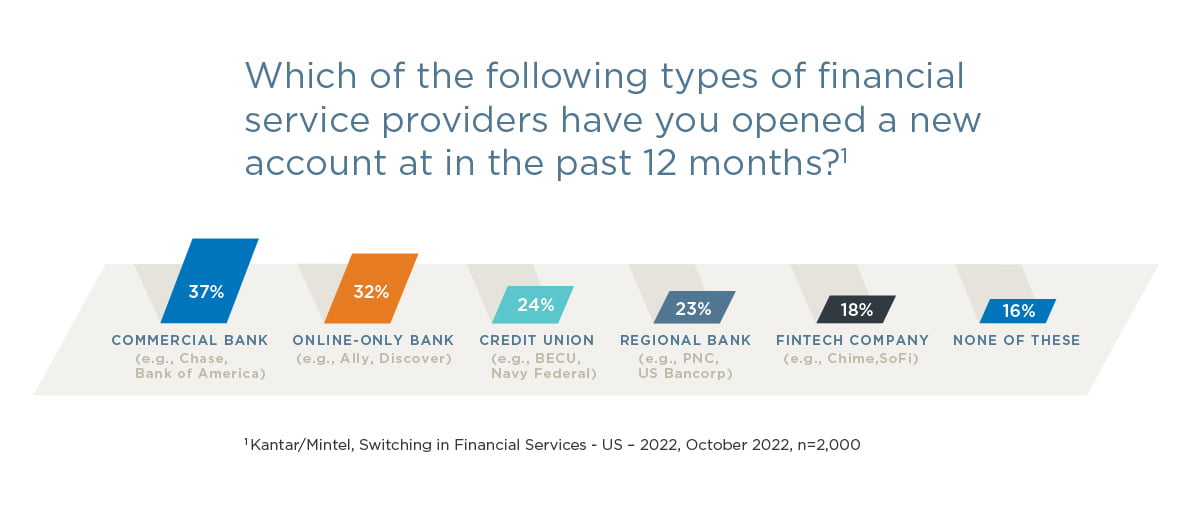

While bigger banks saw an influx in deposits after the SVB and Signature Bank crashes, interest in FinTechs increased, for two reasons. One reason is that FinTechs were quick to mobilize and provide support for entrepreneurs and their employees in need. The other is that while consumers considered shifting their funds, they figured it made sense to look at a FinTech or online only bank that might be able to serve them quicker and better.

Stephenie Williams, VP, Financial Institution Marketing Product & Strategy at Vericast shares, “Some people began to think ‘Well if I don’t trust my bank maybe I should try a non-traditional banking option. [Fintechs and online only banks] are paying more interest. Why not give it a try and see what they have to offer for my money.’”

Banks can win back customer perception, but it’ll take work — strategy, data, listening and efficiency.

Building Relevance

When it comes to building trust and loyalty, relevance is paramount.

“It’s not just about reaching out to customers. Any bank can do that. It’s about knowing me, as a customer, and reaching out to me about what’s important to me. Banks have all the customer data to know what’s important to their customers and what’s going on in their life — yet that data isn’t being used to build connections and show proof of relevancy or foster loyalty with customers,” says Lisa Nicholas, VP, Financial Client Strategy.

“If you have $100,000 and it is sitting in account earning less 1% APY and your banker reaches out to you, letting you know they have an option that will pay 5% APY, your perception is likely to change,” explains Nicholas. “Now you know that your bank is looking out for your best interest, and this fosters a sense of relevance and loyalty.”

With 77% of bank customers saying they expect to be rewarded for their loyalty to financial services companies, the battle for relevance, both in product offering and in messaging channels, is tighter than ever.1

Mind the Gap

However, you could unknowingly fall into a credibility gap, Williams says. “If you haven’t laid the foundation of having regular interactions with your customer and they get communications from you out of left field, they are likely to be skeptical.”

Another gap to be mindful of the disparity between high-tech and high-touch. Throughout 2020 and beyond, there has been a push for self-service, DIY banking. While efficient, this has led to a discounted set of customers who aren’t as loyal as they used to be.

“It’s important to continue to invest in technology. Gen Z and Gen Alpha demand easy-to-use and easy-to-understand tech with instant gratification,” says Nicholas.

According to Kantar/Mintel, 72% of surveyed bank customers agree that in-person interaction is important in building loyalty to financial services brands.2

Williams agrees. “Gen Z and Millennials want advice, and they want to be able to get it face-to-face immediately if they choose. Make sure that while you are adding in technology, you are also finding ways to make it more personal. Technology isn’t a replacement for human interaction. It’s one method facilitating the other.” (For more insight about what each generation wants, get Vericast’s Anatomy of a Banking Customer report.)

Operating Efficiently

Your customers may know you have a lot of data about them. They almost certainly hope you are using it wisely.

Between transaction data, credit information, market data and other data points, financial institutions are poised to have a front-row seat to their customers’ decision-making. When first-party data is coupled with powerful third-party data, the ability to make predictions to benefit the customer— and the bank — increased immensely.

- You can make smart decisions with your marketing dollars. To show relevancy, you need to take it back to the 5 Ws: who, what, where, when, and why.

- Here are some ideas to build relevancy and credibility depending on your organization’s goals and priorities:

- Reaching out to customers with balances greater than a certain amount to offer a higher yielding product like a money market account or CD.

- Reaching out to a customer when you see a decline in deposits or increase in expenses instead of waiting for the typical 30, 60, or 90 days to do a collection call.

- Reaching out to a customer when there is no longer a direct deposit hitting their account – this could be a sign the customer is getting ready to switch financial institutions.

These may seem like a lot of high-touch, low-efficiency interactions but with the correct data and MarTech partner, they can be done efficiently and effectively. The more times you reach out to your customers with relevant information, the greater trust and loyalty they will have in you. It’s easy to put communications based on transactional-focused insights on the back burner but having a designated focus will yield results in building your balance sheet.

Williams sums it up best: “The key is to enrich your first-party data with third-party data. With this, you can tell what your various messages should be and in what market they should show. With the right data and efficiencies, you’ll be able to determine what channel mix is going to help optimize your ad efficiency.”