Setting the Stage

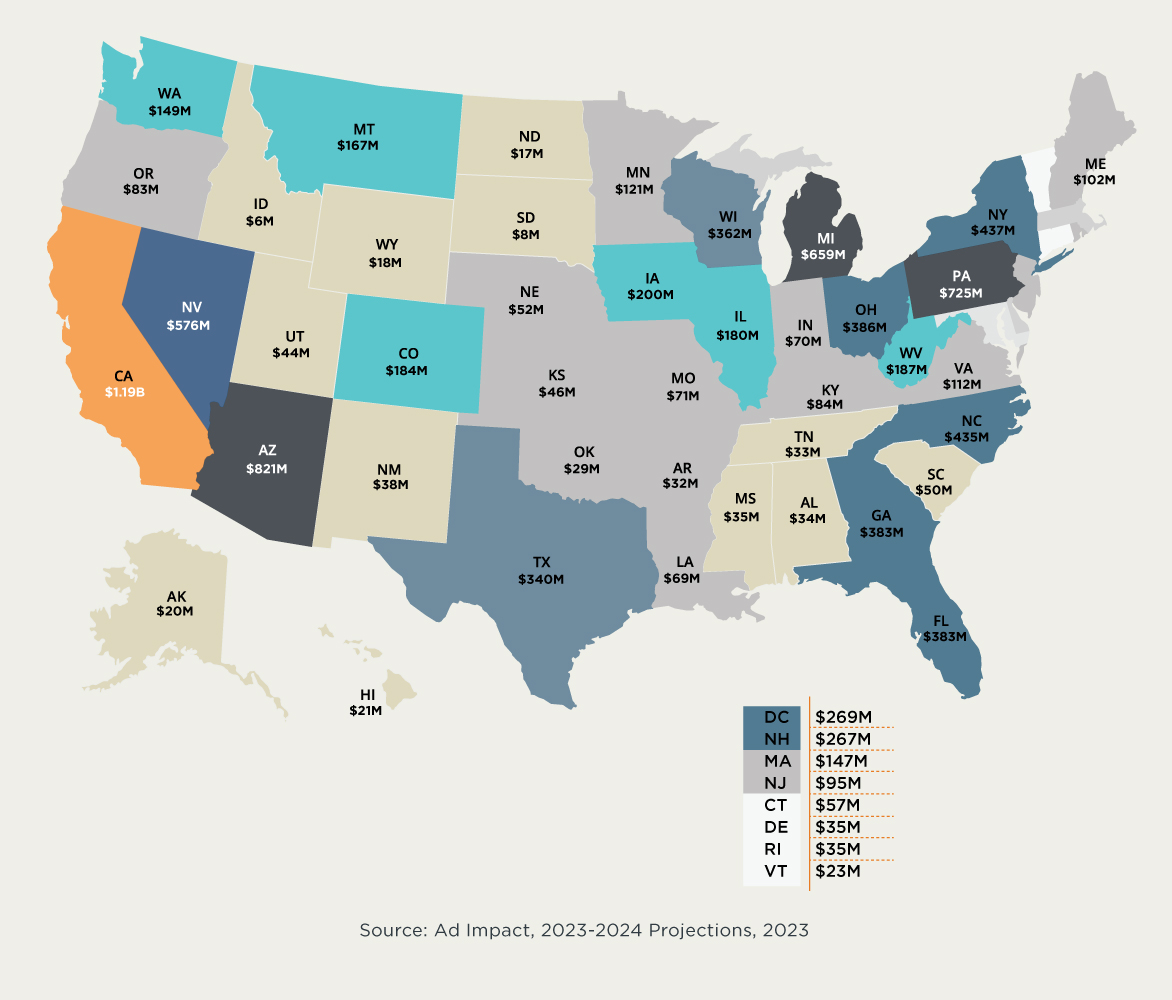

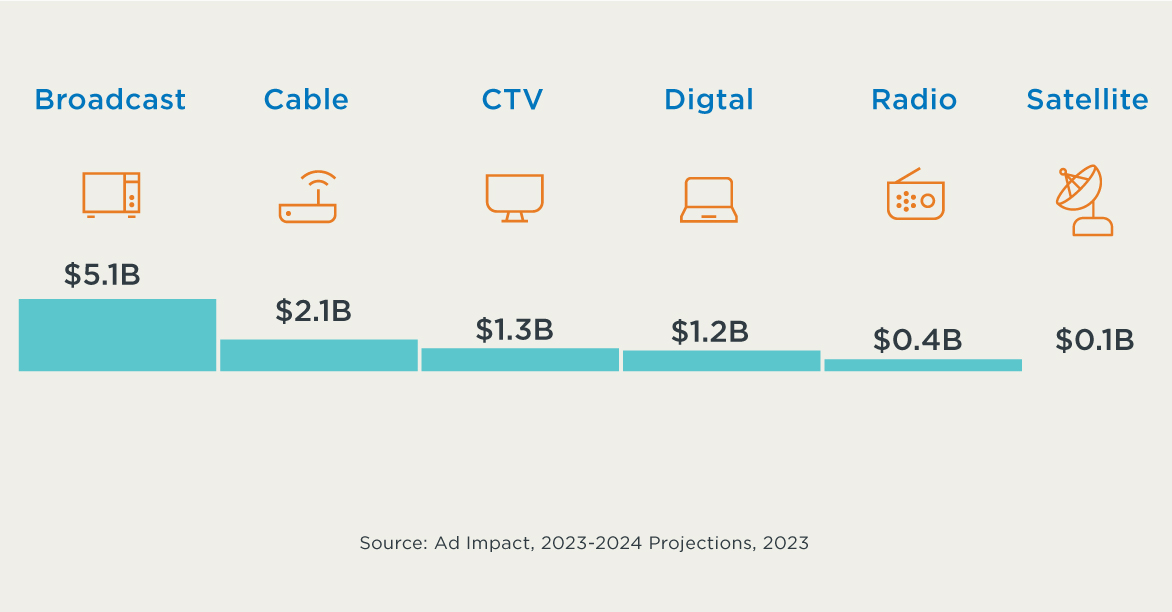

The 2024 Presidential election has created substantial noise in the marketing landscape, especially during Q3, with expectations of continued disruption in Q4. Election-related marketing expenditures are projected to be 13% higher than in 2020, though spending varies significantly by state and across different marketing channels. Notably, nearly half of the anticipated election marketing budget is forecasted to go toward broadcast television. Below is a diagram illustrating the expected election-related marketing spend by state.1

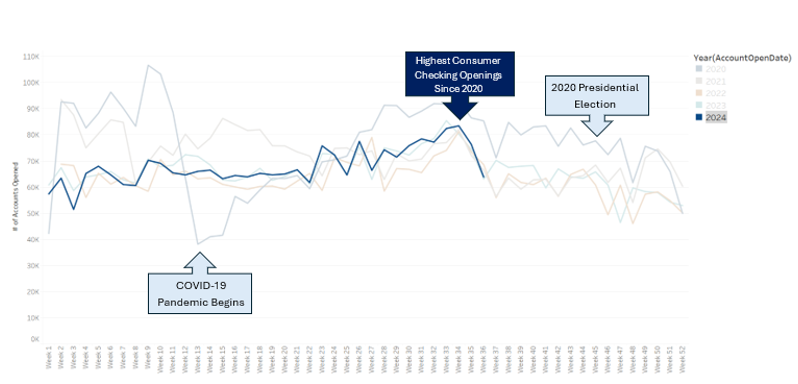

In Q2 2024, checking account openings for financial institutions reached their highest level since 2021. Historically, Q4 has accounted for approximately 20-21% of annual new checking account openings, according to Vericast Client Insights.2

Maximizing End-of-Year Opportunities

In the ongoing race for growth, generating new checking accounts remains a critical objective for financial institutions. While the election may heighten competition for consumer attention, overall market conditions remain favorable for driving new checking account acquisitions. In fact, 2024 checking account volumes are closely mirroring the trends seen in 2022 and 2023.3

As the chart demonstrates, consumers continue to open new checking accounts even during election years. While election-related spending is expected to rise, not all marketing channels will be equally affected. Broadcast and cable channels are predicted to experience the highest

levels of political ad spend.

To stay competitive, financial institutions should focus their marketing efforts on channels that will be less impacted by political noise, allowing them to capture a larger share of new checking account openings.

Stay Competitive in the Race for New Account Holders

Acquiring new account holders in today’s marketplace is increasingly competitive. To enhance your efforts and position your institution for success, consider these strategies for effective acquisition:

- Plan ahead and act now: Stay active in the market, even amidst increased noise from election-related ads. Remain mindful of your specific market conditions and adjust your strategy as needed.

- Prioritize less-impacted channels: Focus on channels like direct mail and digital display, which are expected to see less disruption from election-related spending.

- Differentiate your brand and simplify the user experience: In a fast-paced environment, consumers gravitate toward institutions that offer simple and convenient processes, ensuring a smooth and efficient experience.

Finish Strong and Seize the Opportunity

As the year draws to a close, financial institutions face a unique opportunity to capture new checking account holders despite the election-driven marketing noise. Your institution can withstand the competitive environment and emerge as a leader by proactively adjusting your strategies, focusing on less-impacted channels, and simplifying the customer experience. Now is the time to take decisive action, leverage data-driven insights, and refine your approach to maximize growth in the final quarter.

Ready to finish 2024 on a high note? Download our comprehensive guide today and unlock the tools you need to boost checking account openings, outpace your competition, and set the stage for a successful 2025.

Elevate your institution’s deposit acquisition strategy by utilizing actionable insights and proven methodologies found in this guide.

1 Ad Impact, 2023-2024 Projections, 2023

2 Vericast, Client Portfolio Data Analysis, September 2024

3 Ibid.

4 Ad Impact, 2023-2024 Projections, 2023