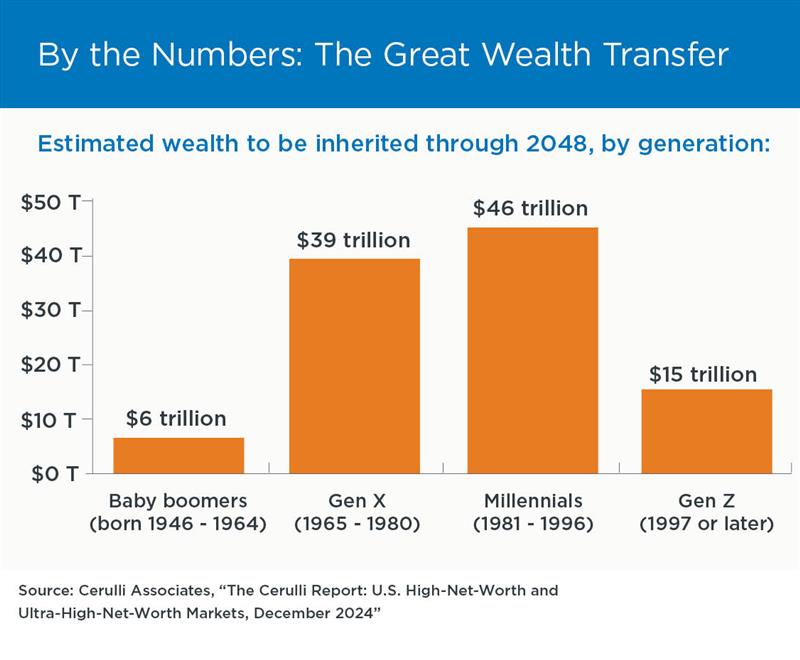

They say you can’t take money with you once you leave this earth, which is true. But financial institutions are about to find out they can’t assume it’s going to stay with them either. There is $124T in all investment types owned by aging generations and, in the relatively near term, that massive accumulation of wealth is set to be acquired by Gen X and Millennials. When the older generations pass away, normal tax and charitable giving rates may make over $1006T in wealth shift to heirs of their estate.

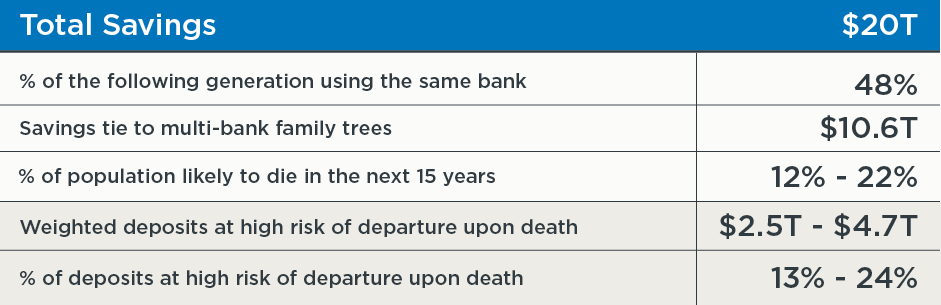

Recent estimates from the Federal Reserve tell us $20T is sitting in savings accounts. Let’s understand the risk that financial institutions are facing: a risk that they might not even realize exists.

Financial institutions should view 13% to 24% of their deposit balance as high risk for departure. None of this has to do with rates, offers, or customer service. Rather, it’s high savings balances with an aging population, where the next generation banks at a different institution. Those deposits very well may walk out the door with little notice and potentially leave behind a balance sheet-altering hole that financial institutions need to fill.

Don’t forget that an estimated $18T in taxes and charitable giving will likely shift away from their current financial institution, which only exacerbates the coming deposit problem.

What You Can Do to Prepare

If your institution has an aging customer base, the risk is very real for massive deposit loss. You should plan now to appeal to broader families to retain those balances. You should also plan for new customer growth to replace the anticipated inheritance flight.

If your institution has a younger population, you could reasonably expect a potential influx of deposits that could alter your deposit base significantly. Planning now to capture those funds in a long-term way could significantly alter the future trajectory of your balance sheet for a long time to come.

Vericast can help you mitigate risk and develop a plan for your credit union’s or bank’s future. Contact us to have a conversation about your deposit strategy.