Economic shifts are reshaping consumer priorities. While many feel cautious, this environment creates meaningful opportunities for financial institutions (FIs) to step in with personalized solutions to bring confidence and clarity.

To understand how consumers are feeling about their finances and long-term goals, Vericast surveyed 1,000 U.S. adults in late May 2025 about their current financial realities. The study provides critical insight you can leverage to meet consumers where they are and develop stronger relationships.

Financial Awareness is High and FIs Can Build on It

When asked whether the current market uncertainty made them more aware and tuned into their finances, a striking 85% of respondents said yes. This rose even higher for Gen Z at 91%. Consumers are specifically more aware of their account balances with 64% overall, 74% of Gen Z, and 70% of Millennials noting so.

Looking at consumer sentiment shows a stark reality: only 19% of respondents say they are very positive about their current financial wellbeing. It’s likely this is a contributing factor leading to only 28% of Americans trusting their current financial institution to help them navigate this uncertainty.

FIs Have an Immediate Opportunity to Rebuild Trust

Now is the time to lead with transparency, empathy, and education. Personalized offers and data-informed communications not only help consumers make confident decisions, but they also differentiate your FI as a true partner in progress. You want your approach to be personalized and relevant, using tools that help consumers understand their options and achieve long-term goals. Banks and credit unions can differentiate through relationship-driven transparency and helpful, data-informed communications, and need to be ready to step in with value-driven products.

Consumers are Adjusting but Remain Cautiously Active

A majority of consumers (72%) say they’ve had to adjust their spending habits due to recent economic conditions, with 28% of Millennials and 31% of Gen Z saying they’ve had to significantly reduce spending. On top of that, 33% of respondents noted having to delay large purchases such as homes, cars, and appliances over the last year. This is even higher among Millennials (37%) and Gen X (36%).

Since January 1, 2025, one in three Americans have either taken out a new personal loan or considered doing so due to economic pressures – clear proof that lending opportunities remain strong when products are personalized and accessible. Younger age demographics appear to be feeling the burden even more with 45% of Millennials and 44% of Gen Z taking out loans or considering it.

There is Significant Opportunity with the Right Education

Education is the bridge between awareness and action. Leveraging market insights, community-specific patterns, and regional economics can help create relevant offers that resonate with the real-time needs of potential borrowers.

Even with consumers feeling the need to delay purchases, they remain open to financial offerings that can address their unique needs. Based on the data, this is especially true for Millennials and Gen Z, so tailored engagement to these demographics is crucial as well as emphasizing trust, transparency, and flexibility in loan products to help convert consideration into action.

Americans Are Ready for Guidance

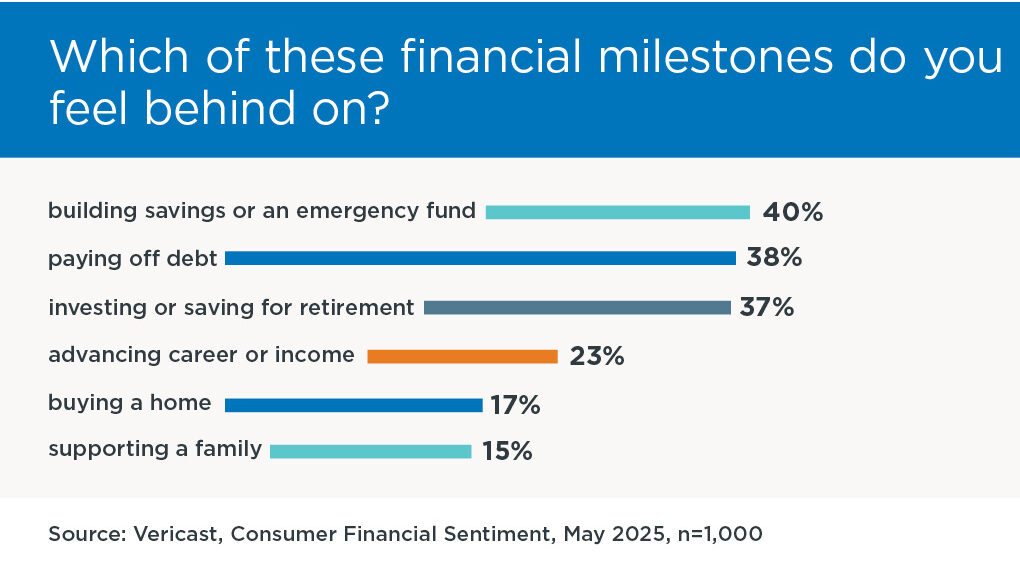

Looking at financial milestones, Americans feel behind in a lot of areas due to the current economic uncertainty and pressure. At the top is building savings or an emergency fund at 40%. Other concerns include paying off debt (38%), investing or saving for retirement (37%), advancing career or income (23%), supporting a family (15%), and buying a home (17%), Overall, 73% of respondents feel behind on at least one of the major milestones mentioned here, creating natural engagement points for FIs.

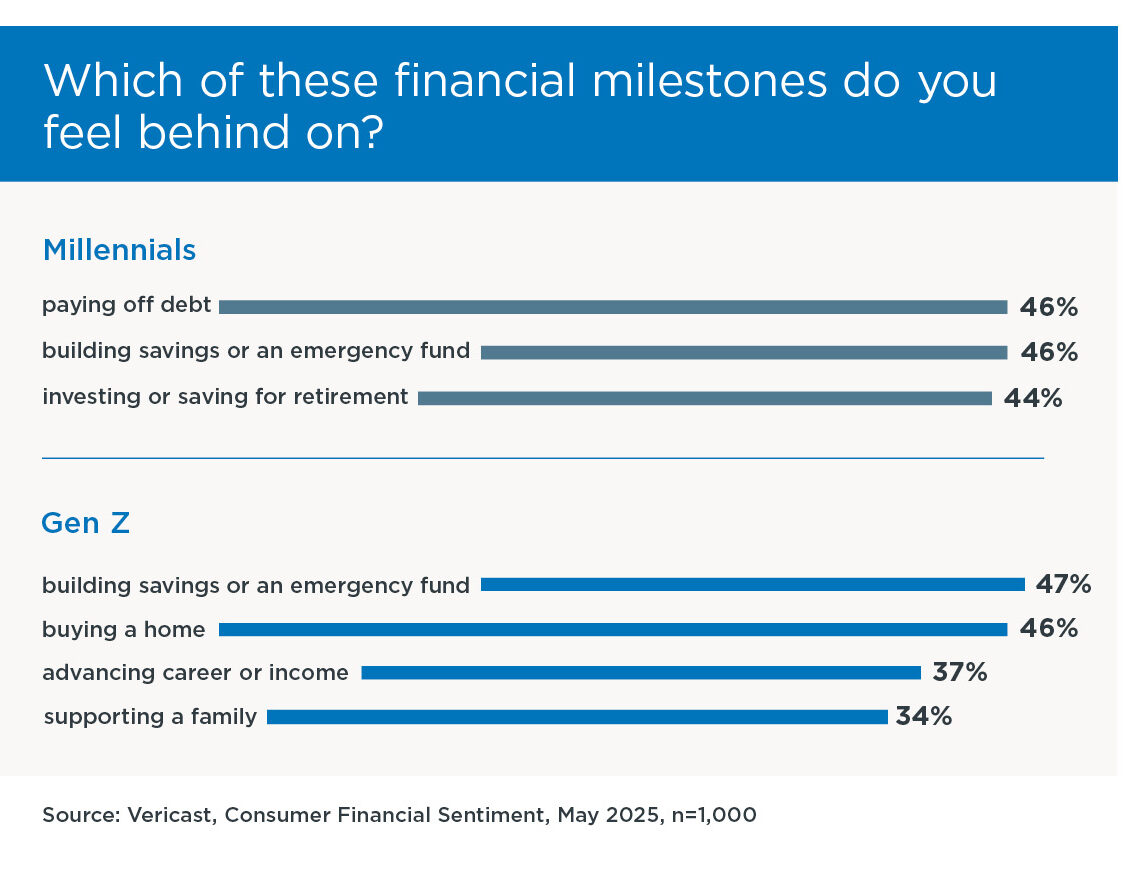

Younger generations are feeling the struggle. Nearly half of Millennials (46%) feel behind paying off debt and building savings or an emergency fund. When it comes to investing or saving for retirement, 44% of Millennials feel behind. Gen Z is particularly concerned about building savings or an emergency fund (47%) and 37% don’t feel like they are advancing their careers or income. Nearly half (46%) of Gen Z respondents don’t believe they’ll ever be able to afford a house, and more than a third (34%) feel the cost of living is so high they are no longer considering starting a family.

Take on the Role of Partner to Help Consumers Achieve Financial Goals

There is both an emotional and practical toll that the current financial insecurity is taking, especially on younger consumers. FIs need to acknowledge these concerns and fears when engaging with customers, offering solutions that are real and feel achievable.

Content and product offerings that support generational lending and financial literacy goals can help consumers right-size their position. This could consist of customized lending products, educational resources, and marketing messages that validate financial stress while positioning your FI as a partner in progress, not just a provider of services.

Stay Competitive by Providing Younger Generations with Proactive Financial Support

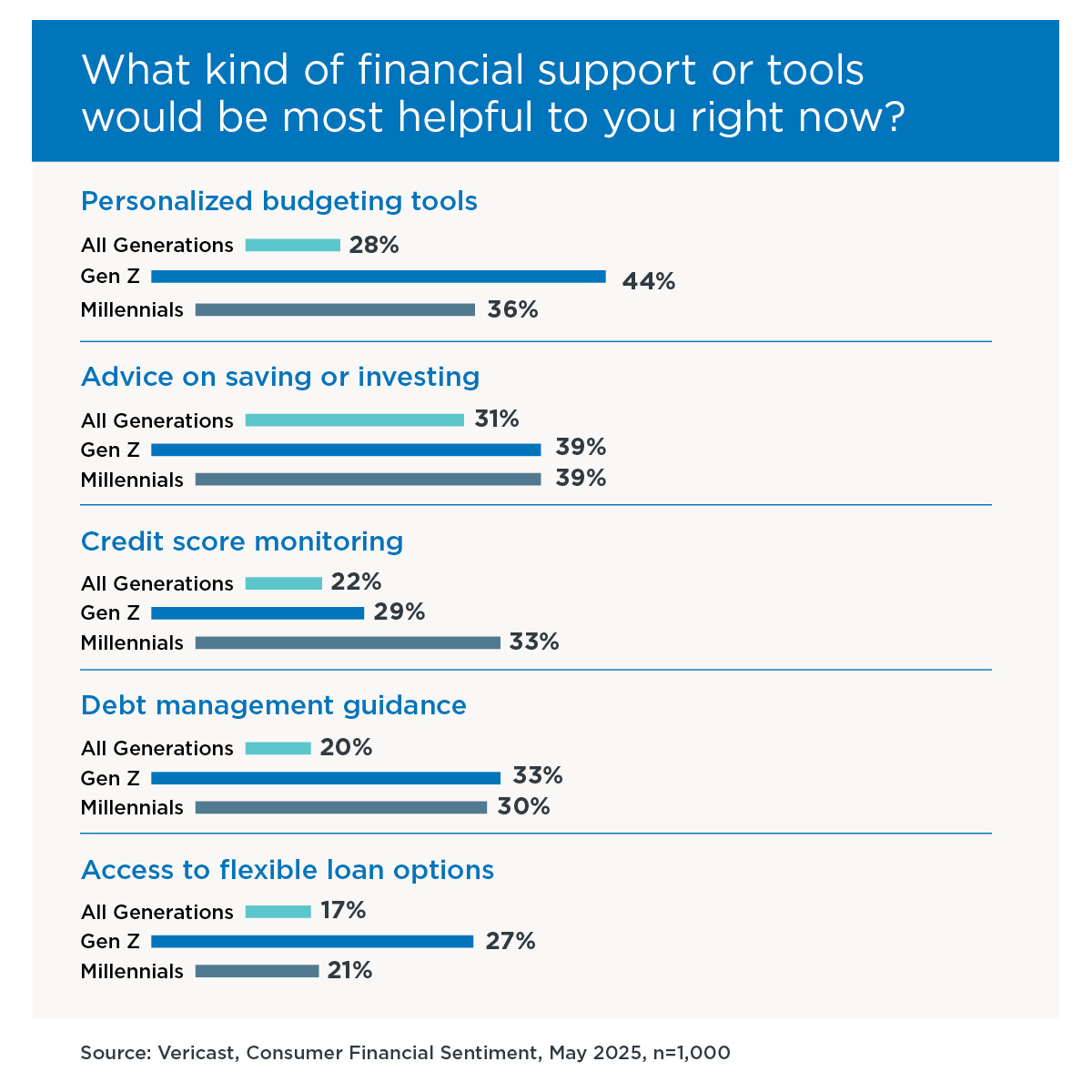

One in five consumers plan to evaluate their current financial and banking services. FIs are not immune as consumers reassess their everyday expenses, but there is opportunity to remain competitive through better customer relationships. Millennials and Gen Z alike are looking for personalized budgeting tools (36% and 44%, respectively) as well as advice on saving and investing (39% for both), debt management guidance (30% and 23%), and credit score monitoring (33% for Millennials, 29% for Gen Z).

Economic uncertainty doesn’t have to equal consumer insecurity. By leaning into personalized, transparent, and locally relevant engagement, financial institutions can transform today’s challenges into tomorrow’s growth opportunities – for both the bank and the consumer.