For those with a credit card, chances are they’ve paid interest on a bill before. While the advice is to always pay credit card bills in full every month, for many consumers it may not always feel possible. But is that the actual reality?

Many consumers have other financial assets that can be used to pay down credit card debt, but either don’t realize they do or choose not to. This behavioral pattern, called co-holding, has been under a microscope for some time as financial institutions (FIs) look to support consumers in changing or reducing the behavior.

To get to the root of co-holding amongst American consumers, Vericast surveyed 1,000 U.S. adults in October 2025 to understand cardholder habits and thought processes, particularly amid ongoing economic uncertainties. The 2025 U.S. Consumer Co-Holding Study sheds light on why consumers are co-holding, what’s keeping them from reducing this behavior, and the opportunity for FIs to implement successful co-holding interventions.

Why Do Americans Co-Hold on Credit Card Debt?

According to an article Vericast participated in with Forbes, there are three main reasons why cardholders might be co-holding.

- Lack of Awareness: Consumers don’t realize that they could or should leverage liquid assets to help pay down debt.

- Purposeful Budgeting: Liquid assets may be planned for other payments or purchases, and consumers are looking to practice self-control in spending and borrowing.

- Inertia or Status Quo Bias: To avoid the perceived loss of other finances, such as liquid assets, consumers may choose to keep things as they are.

How Common Is Co-Holding and Who Is Doing It?

Looking at our data, just over a third (34%) of consumers are co-holding. Breaking it down by gender, 35% of men and 33% of women engage in co-holding. Younger age groups are also more likely to exhibit this behavior: 43% of Gen Z respondents and 42% of Millennials. Specifically, these datapoints stem from respondents confirming they have both positive balances in a checking account, savings account or other liquid asset account while also having a positive balance on a credit card.

When asked why they pay interest instead of paying down credit card debt despite having the savings to do so, nearly one in four (24%) say even though they know they can save on interest, they still prefer to keep liquid assets untouched to maintain savings or liquidity, leaning into purposeful budgeting and inertia. Further, 45% pay attention to the amount of credit card interest they pay every month, but only 32% always pay balances in full to avoid paying interest.

The demographic data paints an even deeper picture:

- 51% of men pay attention to the amount of credit card interest, but only 31% pay off balances in full each month

- 39% of women pay attention to interest amounts and 34% say they always pay balances in full each month

While men give more attention to interest amounts, women are slightly more focused on simply paying full balances from month to month.

Different age groups also display different approaches:

- 54% of Millennials and Gen Z pay attention to interest, but only 21% and 20%, respectively, pay monthly balances in full

- 59% of Baby Boomers pay credit card balances in full each month, which makes sense why only 26% pay attention to interest

The data reveals a commonality among consumers in overall spending behavior. Specifically, 40% of consumers have a balanced approach, where they plan out spending but will also make spontaneous purchases. Many consumers are also quite deliberate in their spending behavior with 32% noting they plan for big purchases and will allow some flexibility based on that planning. This points to consumers wanting to keep liquid assets where they are in case they need flexibility to tap into them for unplanned purchases.

What’s Keeping Consumers from Reducing Their Co-Holding?

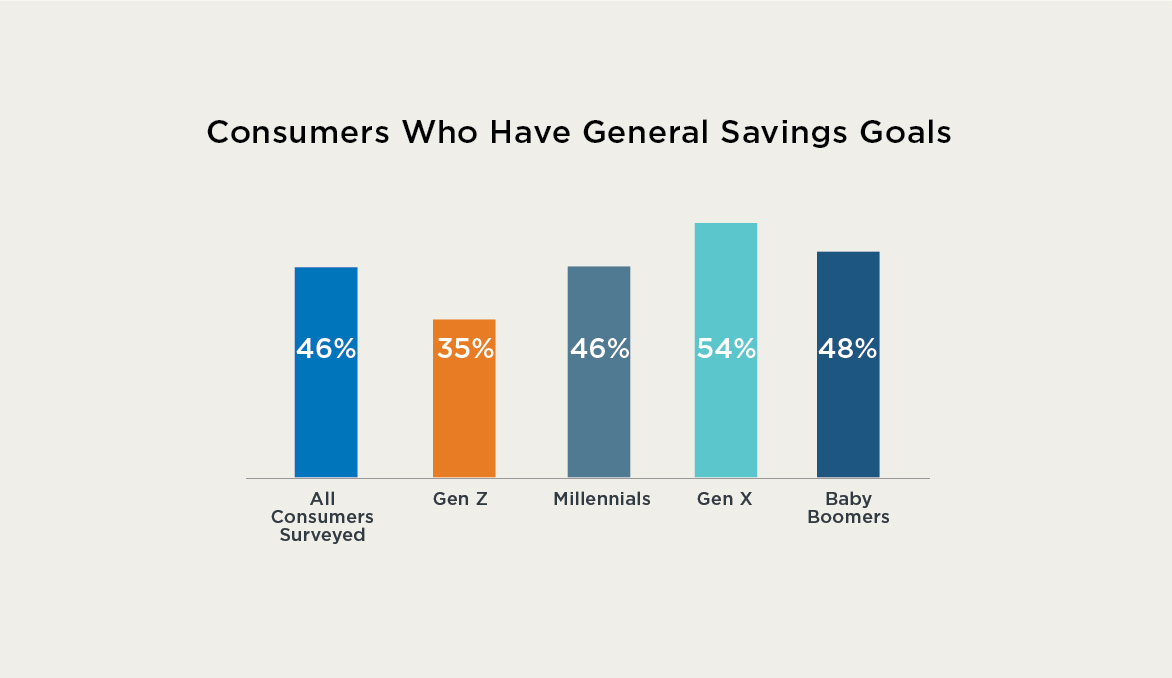

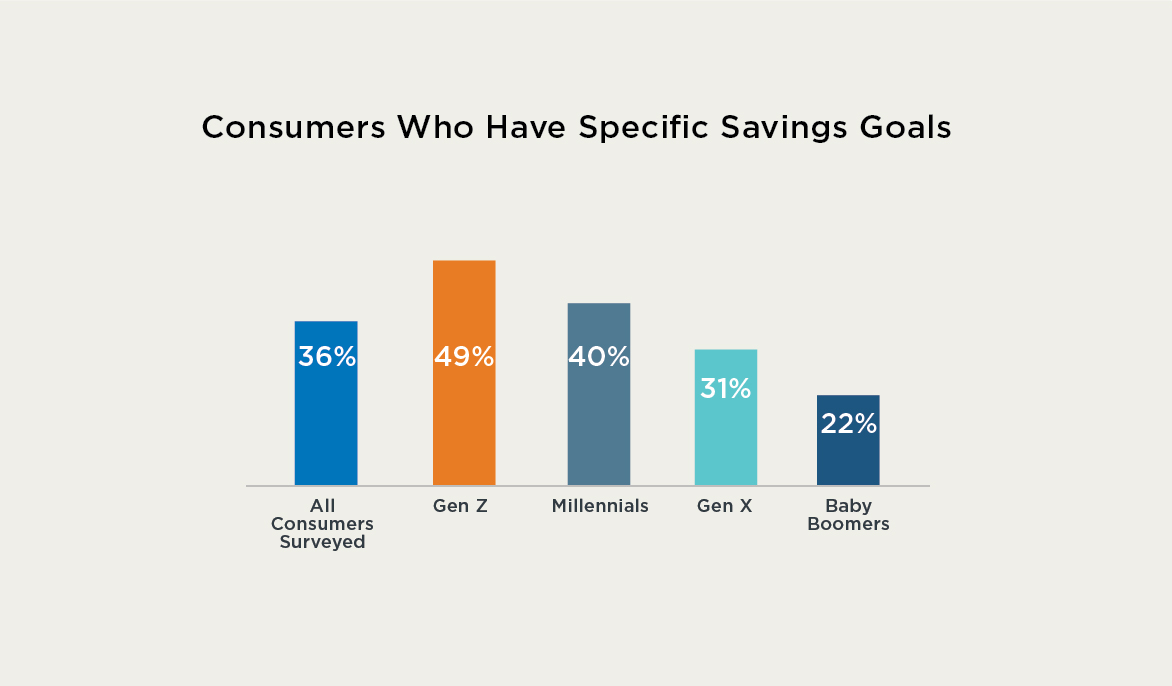

American consumers have both specific and general goals in mind when it comes to spending.

Source: 2025 U.S. Consumer Co-Holding Study, Vericast/Dynata, October 2025, n=1,000

Ultimately, the data shows us that consumers who co-hold largely want to avoid disrupting the status quo of their finances. This could point to a fear among consumers that paying off credit card debt might mean not having liquid assets for other large or unforeseen financial needs that may occur. Consumers likely feel more comfortable seeing money in the bank and perceiving that as positive cash flow, versus paying down a debt and seeing their accounts look more depleted.

How FIs Can Show Up for Consumers to Help Reduce Co-Holding

Our research shows that 55% of respondents have liquid assets they could use to pay down credit card balances, but as noted, only 24% prefer to keep liquid assets untouched. So, what can FIs do to connect with the other 31% who have the liquidity to pay down their debt, plus potentially reach more?

Given that more than a fourth (26%) of consumers would sign up for a low-cost payment service to help reduce how much interest they pay, there’s opportunity for FIs to lean into tactics that can help consumers feel more secure in their savings. It’s also important that FIs market these offerings and options to the right consumers in ways that help fuel growth and impact. Targeted, personalized communication is the name of the game.

At the end of the day, consumers want financial support that will help them maintain and grow their lifestyle preferences. As such, FIs need to double down on supplying more robust educational resources and flexible offerings and effectively communicating that to people. It‘s important to communicate the drawbacks of growing debt and how working with an FI to reduce co-holding actually helps consumers address financial needs and achieve goals over time.

To meet consumers where they are, FIs should consider revamping debt management and personalized budgeting tools as well as upleveling their messaging on simple and flexible loan options. In cases where these already exist, make sure to deploy marketing campaigns that make customers and potential customers aware. Acknowledging the growing role that co-holding plays in consumers’ finances and providing the right education and solutions to support successful interventions means the difference between a true financial partner and just another bank. Ready to connect with consumers using the right marketing and messaging tactics?

Find out how Vericast helps FIs accelerate performance