Summary

- Are people feeling more or less optimistic about 2023 than they did about 2022?

- Vericast’s fall 2022 survey compared results from the prior year’s survey to find out.

- Here, we share key trends and takeaways critical to brands looking to successfully engage consumers this year.

There are a few familiar buzzwords that defined the consumer experience in 2022:

Inflation.

Interest rates.

Gas prices.

The words that will define 2023 remain to be seen, but as part of our most recent Awareness-to-Action Study, Vericast surveyed consumers about their priorities, preferences and plans for 2023. After analyzing the data and comparing it with results from prior year’s survey, we uncovered key trends and takeaways critical for brands looking to successfully engage consumers this year.

Some Consumers Are Welcoming the New Year With a Dose of Pessimism

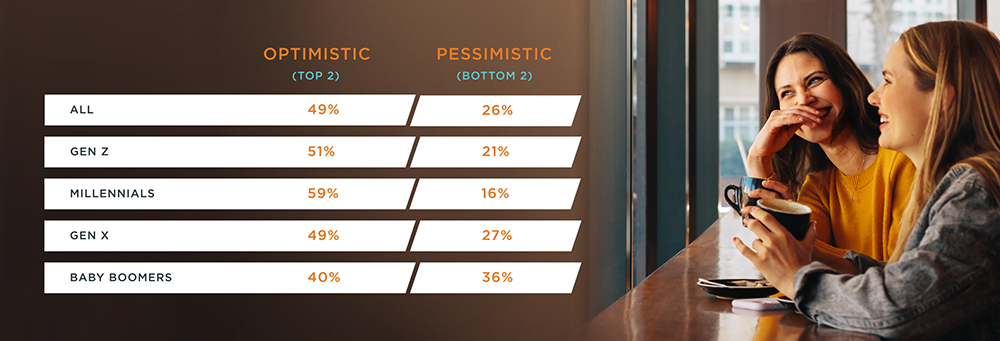

Not surprisingly, many consumers are concerned about what lies ahead for 2023. Weariness from the economic ups and downs of 2022, as well as the pending uncertainty of the future has given them a pessimistic outlook for 2023. Optimism is down significantly for baby boomers who are bracing for a financially stressful year. In contrast, Gen Z reports significantly more optimism going into 2023 compared with 2022. Not surprising, those who are very or somewhat comfortable financially are much more optimistic than those living paycheck to paycheck or under great financial stress.

Consumers Have a Plan for Weathering 2023

In response to the strained economic outlook, consumers are taking steps to improve their financial situation. According to survey respondents, their top financial goals for 2023 remain unchanged from 2022: save money, cut expenses and pay down debt.

When it comes to saving money, millennials and millennial parents are more likely than other groups to plan to put more into savings next year. This represents a significant increase for millennial parents (43% for 2022 plans compared with 51% for 2023 plans).

Survey responses indicate consumers planning to cut costs in 2023 increased from 33% to 41%, particularly for baby boomers and affluent consumers. The top expenses consumers plan to cut are food/grocery shopping, restaurant dining, and gasoline. In addition, 24% of millennials and 24% of millennial parents plan to cut subscription services such as meal kits and beauty boxes.

How Do Consumers Plan To Change Their Purchasing Habits in 2023?

Considering the looming economic concerns, do consumers plan to adjust their purchasing? When it comes to major purchases, respondents overall intend to maintain their 2022 level. The exceptions are Gen Z, who say they intend to make a major purchases — a change from 2022 — as well as baby boomers, who are less likely to make a major purchase in 2023 compared with 2022.

Examples of the big-ticket purchases consumers plan to make include vacations, technology and home improvement. Respondents say they will purchase more new technology in 2023, and while still a top purchase, home improvements/remodels will be down from last year.

More survey respondents report they will stay in more instead of going out, four-point increase over last year. Thirty-two percent of respondents say they’re more comfortable staying home these days, especially parents and millennial parents.

When they do spend on other things, respondents will likely make more “practical” purchases. This is especially the case with baby boomers given the financial headwinds they expect to face in the coming year. As practical purchases increase, it appears plans to make “fun” purchases are down, an example of the focus on austerity.

How Can Brands Win Over Consumers in 2023?

With today’s high rate of inflation, competition for consumer dollars is fierce. And, as price becomes more of a factor in everyday purchase decisions, brand loyalty takes a hit. Our survey reveals that today’s consumers are less influenced by labels and are instead on the hunt for interactions and deals that deliver value.

There’s good news, however. Brands can take steps to help consumers achieve their priorities and, in the process, win consumers’ loyalty. It boils down to three main opportunities:

1. Help consumers save money. Coupons are cool again. Sixty-six percent of respondents say with the current economy, coupons and discounts are more important than ever. This resonated the most with baby boomers and those living paycheck to paycheck.

2. Reward consumer loyalty. When consumers receive a reward or discount for their purchase, it makes them feel more positive toward a brand/store and experience greater customer satisfaction. Even better, they’re also more likely to make a repeat purchase.

3. Help consumers save time and generally make their life easier. Sixty-three percent of respondents say they are “looking for ways to achieve balance between saving time and saving money.” This is especially true for millennials, parents and the affluent.

(Bonus!) Keep it light! Perhaps it’s the heaviness of world events of the past few years, but consumers value brand messaging that delivers a dose of humor to their day.

Learn more about consumers’ expectations for 2023 to earn their confidence through your marketing plans — explore the 2023 Consumer Outlook.