New customer acquisition has never been more important. Influencing customers to switch requires a strategic mix of channel and message.

How it Works

A top-tier checking acquisition strategy is critically important to drive the overall success of any bank or credit union.

Vericast’s Checking Engine represents a holistic and comprehensive solution, built on the vast expertise of our in-house team with years of experience in financial institution marketing, privacy, media, and compliance with regulatory matters.

Checking acquisition requires a persistent, data-driven approach. Our dynamic solution integrates five key steps into a continuous loop that allows you to repeatedly improve performance and optimize marketing spend. From identifying the highest opportunity markets with branch presence (where we know consumers are in market for your offers), to sophisticated Media Mix Modeling to ensure the right channel mix, Checking Engine drives low-cost acquisition through intelligence.

Checking Engine addresses the five essential questions of acquisition programs:

- Where are the best markets?

- What is the best mix of channels?

- How do I optimize spend and results?

- How do I execute multiple channels effectively?

- Did campaign performance meet or exceed expectations?

Leverage Data-Driven Intelligence for Cost-Effective Acquisition

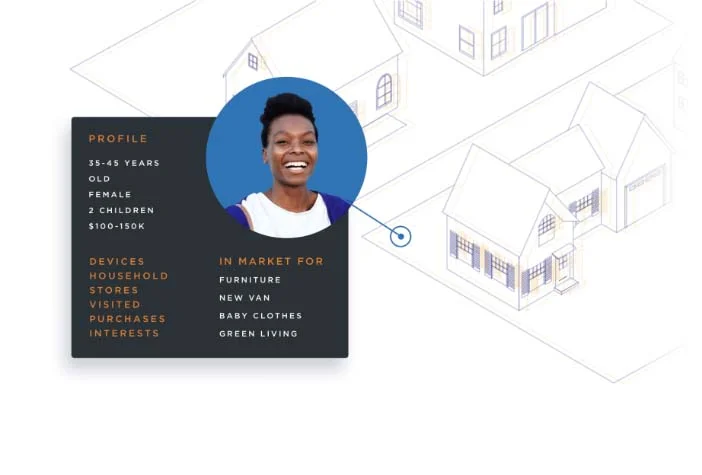

In building your custom acquisition strategy, Vericast utilizes our proprietary Consumer Graph™, cost-effective media channels, award-winning media bidding technology and creative design.

Vericast can drive a lower CPA (Cost Per Acquisition) for you on media execution with our exclusive blend of direct mail and digital channels. We’ve been able to showcase over 1.7 billion print + digital ad impressions to in-the-market clients last year alone. We have a rich history of working with over 5,000+ financial institutions who trust us to deliver their marketing messages.

Enhancing Customer Acquisition and Retention

- Improving Acquisition and Retention Within Compliance Boundaries:

How can we increase customer acquisition and retention in banking while adhering to compliance requirements?

- Vericast has invested in industry experts including former regulators to understand applicable laws in detail including UDAAP, CRA, and Fair Lending Acts.

- Through our command of compliance, we create audience selection and deployment strategies by using approved criteria as noted by regulations.

- Selecting Optimal Markets for Campaigns:

How do we identify the most promising markets to target for our marketing efforts?

- Our Market Intelligence Platform uses a proprietary approach to rank geographies by low, medium, and high opportunity. This powerful tool seamlessly integrates multiple data sources in compliance with UDAAP to arrive at a Checking Opportunity Score that identifies the markets and consumers most likely to be receptive to your offers.

- Proprietary and external data is filtered by Market Potential, Market Activity and Market Competition. Attributes are assigned within each, including product and client household penetration, and exclusive consumer intent signals from the Vericast Consumer Graph™.

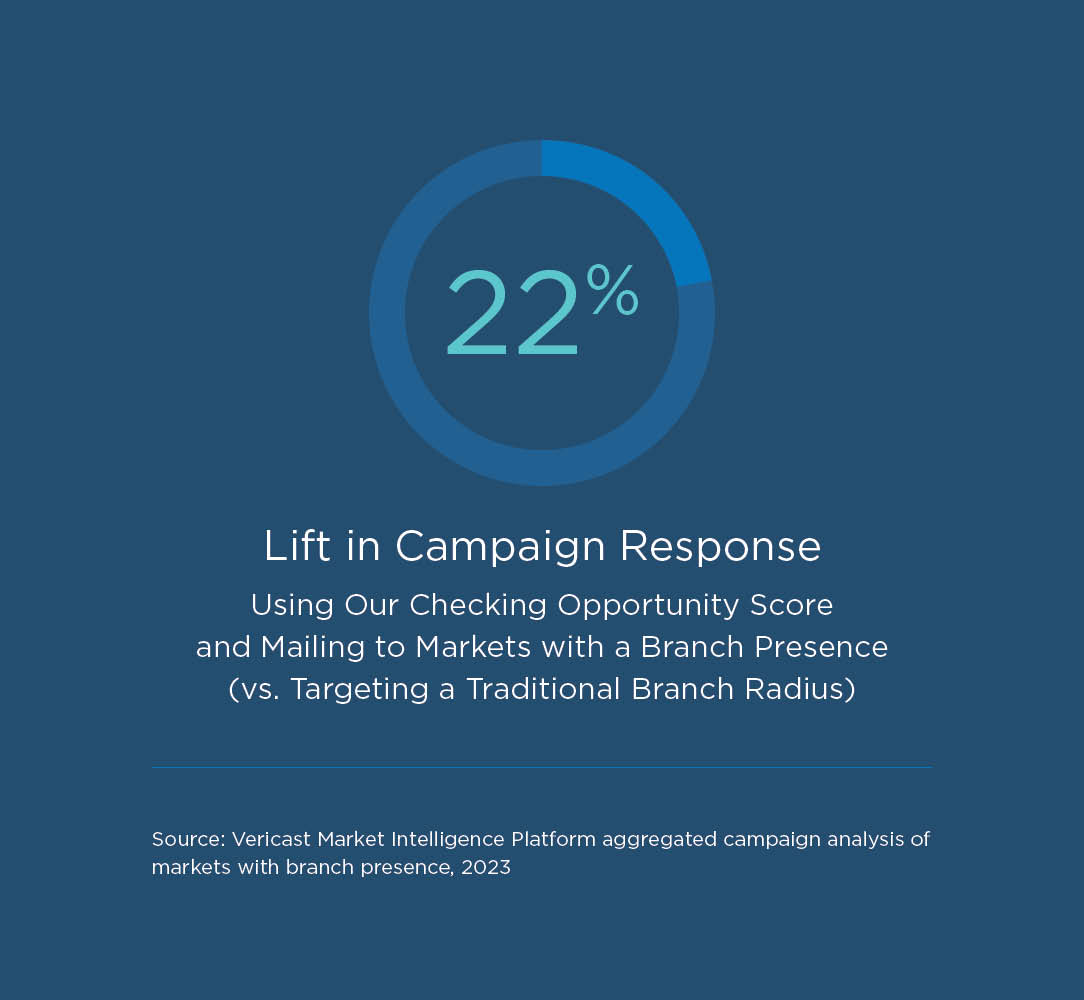

- By scoring the highest opportunity markets, we’ve seen a 22% average lift across campaigns when compared to targeting a traditional branch radius.

Source: Vericast Client Performance Studies, Fall 2023.

- Strategizing Media Spend for Target Markets:

- How can I allocate my budget to the best media channels for the markets and targets I want to reach?

- With more scrutiny on budget and results, it’s critical to have data science behind the channels you choose. Media Mix Modeling charts potential outcomes and delivers sophisticated insights with a high degree of accuracy.

- Historical data, macro factors, and the Vericast Industry Model are used to inform the best channel mix. Media Mix Modeling uses probabilities to quantify what we believe to be true, ingesting the latest information to execute, learn, and repeat.

- How can I allocate my budget to the best media channels for the markets and targets I want to reach?

- Media Spend Optimization for Peak Results:

What approaches should I take to fine-tune media channels for optimal budget utilization and the highest possible outcomes?

- Vericast’s Financial Institution Performance Simulator is a powerful tool using data and in-tandem strategist knowledge to drive projections

- This tool uses data from our proprietary Market Intelligence Platform and media mix modeling strategies to answer to determine optimal spending and media channels for checking acquisition campaigns in real-time. We can focus on factors including:

- Projected number of accounts

- Cost per account by geography

- Top ZIP codes by balance

- And more!

- Boosting Response and Minimizing Acquisition Costs:

What are the strategies for increasing campaign response rates while reducing the cost per acquisition?

- Vericast’s multichannel approach helps you execute multiple channels, increase response and lower CPA.

- Checking Engine features proprietary direct mail channels to drive down CPA without compromising performance.

- Evaluating Campaign Performance:

How can the effectiveness of marketing campaigns be measured and improved for greater impact on customer retention and acquisition?

- Understanding performance is critical to your short and long-term goals. With Checking Engine, we improve access to data and ensure it is fed back into the model to fuel continuous growth and improved results.

- Vericast does this by utilizing a dedicated team of financial institution-specific analysts and strategists, providing you with a custom campaign scorecard with informative, impactful analysis and reviews that are automatically fed into Checking Engine in real-time.

You may also be interested in…

Don’t plan your next deposit and acquisition campaign without considering this important insight.

In this blog, Stephenie outlines the critical compliance factors that financial institutions should consider and their implications for acquisition marketing.

Matthew Tilley speaks with industry experts Lisa Nicholas, Chris Phelan, and Stephenie Williams to break down the challenges marketers in financial institutions face in uncertain economic conditions, and how to work through them.